Category: why get payday loans

Customers is contact the financial institution where their RRSPs take place for additional pointers

December 2, 2024

In case the client doesn’t allege the fresh reimburse at the time of your own import, then taxation are payable in the membership, to your refund claim being produced directly to brand new Ministry from Finance; the customer need fill out an identical Affidavit along with a copy of your inserted transfer/deed, and lots of extra data. Of these homebuyers that has participated in the fresh now-obsolete Ontario Home ownership Offers Package, there’s a certain setting for use when creating an enthusiastic app for the reimburse out-of homes transfer income tax. Find

The house Customer’s Package are a national initiative allowing basic-time consumers so you’re able to withdraw and rehearse money on put inside their Inserted Senior years Savings Arrangements with the the acquisition out of a property, in the place of running into plain old taxation outcomes regarding RRSP detachment. Into the a twelve months, an individual may take to $twenty five,000 within the RRSP money toward purchase of a property; spouses and you may well-known-law partners are also eligible to contribute $twenty five,000, to own a combined full out of $fifty,000. The RRSP money are used for people aspect of the home get, such as the down-payment, courtroom costs, disbursements, residential property import taxation, home improvements or seats and you can equipment.

But not, in order to take part in the house Buyer’s Bundle, the buyer need to meet particular high conditions. Eg, the customer (and his awesome or her lover, if the relevant):

– need to be a citizen out of Canada; have to be experienced a beneficial “first-go out homebuyer”, as the laid out by Income tax Act;

– must have entered for the a created arrangement to shop for otherwise create a being qualified household to own your otherwise herself, or an associated person that have an impairment, that is meant to be made use of due to the fact a main host to quarters no after than just one year once to shop for otherwise strengthening it:

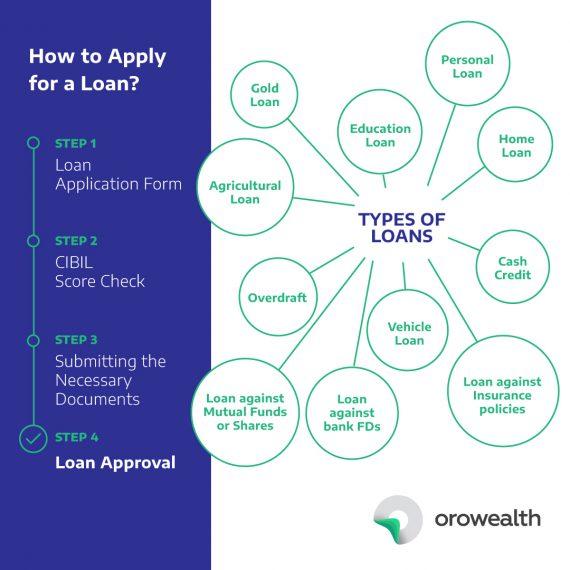

The basics you should make sure when you take that loan include the purpose of the loan and also the borrower’s monetary demands

November 25, 2024

Bodies Incentives Generating Australian A property

Australia is even more attracting a residential property developments just like the marketplace is developing at the a higher level. Regrettably owning a home to possess Australians continues to be difficult and you will homelessness has been a concerning material. Hence, the federal government keeps put up effort which help incentivize the people to the investing residential property and produce the nation’s cost savings while reducing homelessness.

The original-household give owner was a popular model for motivating home ownership just like the where regulators leads to someone’s deals designed for to acquire property. Continue Reading

Score a mortgage that have Large Eligibility & Ideal Rates

November 19, 2024

Qualifications Standards

- Age: New co-candidate must be anywhere between 18 and you may 65 yrs old. Particularly, while 31 as well as your mate is actually twenty-eight, they may be simply because they meet the years requirements.

- Spouses: Couples is actually most readily useful co-people. By applying together, you merge your earnings, that can enhance your financing qualification. For-instance, if the joint money is ?step one.5 lakh a month, you might qualify for a top loan amount than just if you used alone.

- Mothers and you will Youngsters: A father and you will son or good daughter which have one to or one another moms and dads can put on to one another. It plan is fortify the application. Including, in the event the dad enjoys a constant income and you can good credit, their engagement might help safe a bigger mortgage for buying a great home. Continue Reading

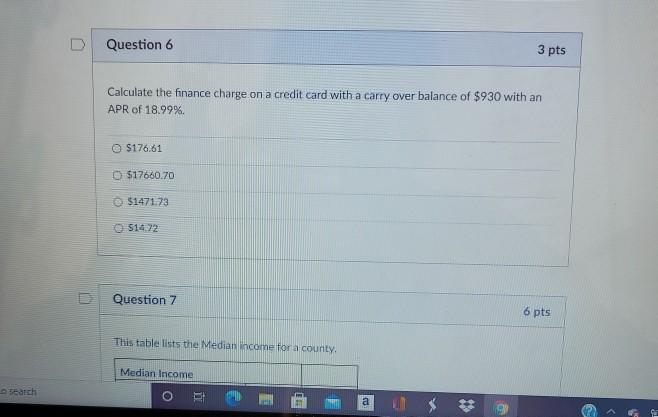

Figuring the debt-to-income ratio try a vital step-in choosing regardless if you are entitled to financing

November 5, 2024

2. The debt-to-earnings proportion affects your ability and then make more mortgage payments: Your debt-to-earnings proportion has an effect on what you can do while making additional mortgage repayments, that will help you repay your own financial shorter and create security of your house. When you yourself have a leading obligations-to-earnings ratio, you’ve got less cash readily available per month and make most mortgage payments. This will make it much harder to create guarantee of your property while increasing the house’s value throughout the years.

3. The debt-to-income loan places Montrose proportion influences your ability in order to refinance your own mortgage: Refinancing your own mortgage is going to be a terrific way to reduce your monthly mortgage repayments and build equity of your property. Although not, when you have a top personal debt-to-income proportion, you have got a more challenging go out refinancing your financial. Loan providers is generally less likely to want to accept your application, otherwise they may provide you with increased rate of interest, which can make refinancing quicker glamorous. Continue Reading

E= P X r X [(1+r) ^n/ ]

October 29, 2024

Auto loans are a type of unsecured unsecured loan regularly purchase an automible. Yet not, interest in which invention has grown recently. Ergo, numerous financial institutions arranged loans specifically designed to get to know the goal from acquiring a different car. ICICI Financial try India’s 3rd-prominent personal markets bank because of the sector capitalization. Its a popular financial institution giving auto loans on aggressive interest levels. In addition, they offer products for instance the ICICI auto loan EMI calculator. It assists users in calculating its month-to-month payback obligations before you apply to have an advance. Numerous loan providers put up loans created specifically in order to meet the objective out of obtaining another vehicle. Such automobile financing is covered because of the another vehicle and provide 100% investment into price. In addition, it allows them to arrange their budget better. Continue reading for additional information on the advantages and you may benefits associated with the ICICI auto loan EMI calculator.

- ? 1L

- ? 1Cr

- 1Yr

- 30Yr

- 7%

- 17.5%

- Monthly EMI

How come this new EMI Calculator Functions?

Where n is the loan length (in months), r is the relevant rate of interest, P is the principal amount borrowed, and E is the monthly payback amount. Let’s take an example where you take out a vehicle loan in 2021 for Rs. 6 lakh, which you have to pay back over 4 years (48 months) at the current interest rate of 9%. Thus, your EMI amount will be as follows based on the aforementioned formula: E= 6, 00,000 X 9% X [(1+9%) ^48/ <(i+9%)>] Therefore, E = Rs. 16,602, and the total interest amount payable is Rs. 3,94,500. Continue Reading

PMI to the Old-fashioned Financing Having Higher than 80% LTV

October 28, 2024

This guide discusses PMI to the Conventional financing having more than 80% LTV. PMI into Conventional fund which have higher than 80% LTV is required for each and every Federal national mortgage association and you may Freddie Mac computer Guidelines. Personal Mortgage Insurance coverage covers lenders though consumers go to your standard in addition to home goes in foreclosure. Individual Financial Insurance policy is Federal national mortgage association otherwise Freddie Mac’s kind of financial insurance.

HUD guarantees loan providers toward FHA finance one standard. The newest property foreclosure continuing become following citizen concludes and work out their monthly mortgage payments for four weeks.

Lenders would not want individuals to go into foreclosure because not one person gains whenever a debtor gets into foreclosures. Both the resident and loan providers cure. New resident doesn’t merely treat their residence but also the credit rating have a tendency to plummet in which it requires going back to all of them in order to re also-establish the borrowing so you’re able to qualify for home financing again. The personal mortgage insurance company pays the financial institution the bucks missing regarding property foreclosure. The lender seems to lose in addition to. It is true while they obtain the losses regarding financial insurance carrier by some time legal fees spent throughout the foreclosures procedures. Personal Financial Insurance agencies enjoys more premiums you to trust the latest individuals.

Cost of PMI to the Old-fashioned Finance That have Higher than 80% LTV

The expense of PMI to your Traditional funds which have greater than 80% LTV is paid back because of the mortgage loan borrower to benefit the fresh mortgage company. Continue Reading

What forms of properties meet the requirements to possess USDA financial?

October 21, 2024

Step 1: Determine Qualification

In advance the applying procedure, determine if both you and the property you’re interested in meet the requirements to own an excellent USDA loan. Use the USDA’s on line equipment to evaluate possessions and income qualification.

Step 2: Get a hold of a beneficial USDA-Accepted Lender

Never assume all lenders and finance companies give USDA loans, so it is crucial that you find an effective USDA-acknowledged mortgage lender which is experienced in the applying. Coastline 2 Shore is proud so you’re able to suffice Ala homebuyers 1 week a week, only complete new Brief Request Means to get going.

Step three: Get Pre-Recognized

Getting pre-recognized to have good USDA mortgage provides you with an obvious tip from simply how much you really can afford and make your a very glamorous client. Locate pre-approved, you’ll want to provide us with paperwork for example evidence of money (w2’s, pay stubs, taxation statements) two-many years of employment records, two-several years of local rental history, and credit advice. Continue Reading

For $10,000 closed-end Family Guarantee Mortgage which have a phrase out of sixty weeks on six

October 10, 2024

^ APR=Annual percentage rate. Cost legitimate at the time of . Maximum CLTV 90%. 25% Annual percentage rate and you can an LTV out of 80% or shorter, the newest payment is $.

^^ APR=Apr. Costs are good by . At least loan amount out of $ten,000 and you can a max loan amount out-of $200,000 can be applied. Have to be first household into the Condition from Florida. Prices are at the mercy of change without notice. For a beneficial $fifty,000 closed-end EZ Refi House Security Loan having a term away from sixty months in the 5.500% Annual percentage rate, the brand new payment is actually $. Continue Reading