Category: what do i need to get a cash advance

Module step 1: Brand new Idaho Institution off Finance

November 21, 2024

- Licensing and you may Examinations

- Details, Strategies, and you can Advertisements

- Prohibitions, Review, and you may Enforcement

- Latest Exam

This new Idaho Company out-of Finance (the latest “Department”) was made because of the Idaho County Legislature in 1905 towards the intent behind controlling the new Idaho financial attributes business. New Department was first guilty of applying the new Idaho Bank Work, and therefore entirely influenced banking companies. That it module ratings brand new Departments and its particular bureaus.

Module dos: Licensing and you can Assessments

Expertise compliant Idaho real estate loan origination practices and procedures needs an exploration of Idaho Residential Financial Methods Operate (IRMPA), codified in the Idaho Code (IC) Term 26, Chapter 29. From this legislative agenda, we’ll feedback necessary techniques, conformity, factors, and you may prohibitions regarding mortgage experts functioning throughout the Idaho. Continue Reading

If you’re considering debt consolidating, comprehend the benefits and drawbacks

November 18, 2024

When you are thinking about an easy way to top manage your earnings, for example filing for personal bankruptcy otherwise paying the money you owe for less than you borrowed, you might also be thinking debt consolidation. In financial trouble combination, you earn just one mortgage to settle multiple almost every other loans, leaving you with only you to payment rather than several. Technically, and make that payment to one collector monthly could be more straightforward to create than simply paying numerous financial institutions.

It is debt consolidation a good idea to you personally? On the self-confident front, debt consolidation always allows you to lower your interest and score a lowered payment count. Toward bad side, you may need to put your household otherwise vehicle upwards as collateral, and you will become expenses a great deal more.

Simple tips to Consolidate Debt

So you can combine the debt, you earn one loan to settle their most other funds, leaving you and come up with a single payment to a single creditor every month as opposed to to make multiple repayments so you’re able to multiple loan providers. Integration fund are either “secured” otherwise “unsecured.”

What is actually a protected Financing?

When taking out a secured financing, such as for instance home financing or a car loan, you guarantee specific possessions, like your household otherwise automobile, to secure the cost of financial obligation. Eg, if you get a mortgage loan, your home acts as shelter having payment. Continue Reading

What is the Requirements to have good 95% Financial?

November 5, 2024

Varying Price Mortgage

Choosing a changeable speed brings down the initially will cost you, but be prepared for month-to-month home loan repayments that can are different more day. I examine different varieties of changeable prices:

- Tracker rate mortgage loans: Such mortgages enjoys their interest prices connected with an outward standard, often the Lender from England’s feet price. This means your month-to-month repayments increases just like the ft price alter.

- Discount adjustable speed mortgage loans: You will be provided a savings off of the lender’s fundamental variable price (SVR) to own an appartment several months. Their month-to-month repayments will vary whenever the new SVR alter.

- Your lender’s basic variable speed (SVR): Very mortgage loans revert with the lender’s SVR immediately after people first financial contract period. This will alter at the lender’s discernment but commonly reflects greater movements in the rates.

Fixed Speed Mortgages

If you want certainty more what you’ll be able to shell out month-to-month, fixed-speed home loan purchases secure your own interest rate having a flat months. One to balances is beneficial when considered outgoings in the early ages off homeownership. And don’t forget to consider remortgaging to a different repaired price for the the conclusion the identity or earlier if required very you are not went on to increased SVR.

Attention Only Mortgages

With the home loan product sales, you pay out-of for each and every month’s focus to the financing and you may not one of capital harmony alone. As such, they offer straight down monthly obligations during the title but require a great credible payment strategy for settling one to investment equilibrium at the maturity. Interest-simply options on 95% LTV is less common and you can include particular financial standards as the better due to the fact cost bundle requirements.

Included in our very own service, i have a look at all the selection which is best for you. Continue Reading

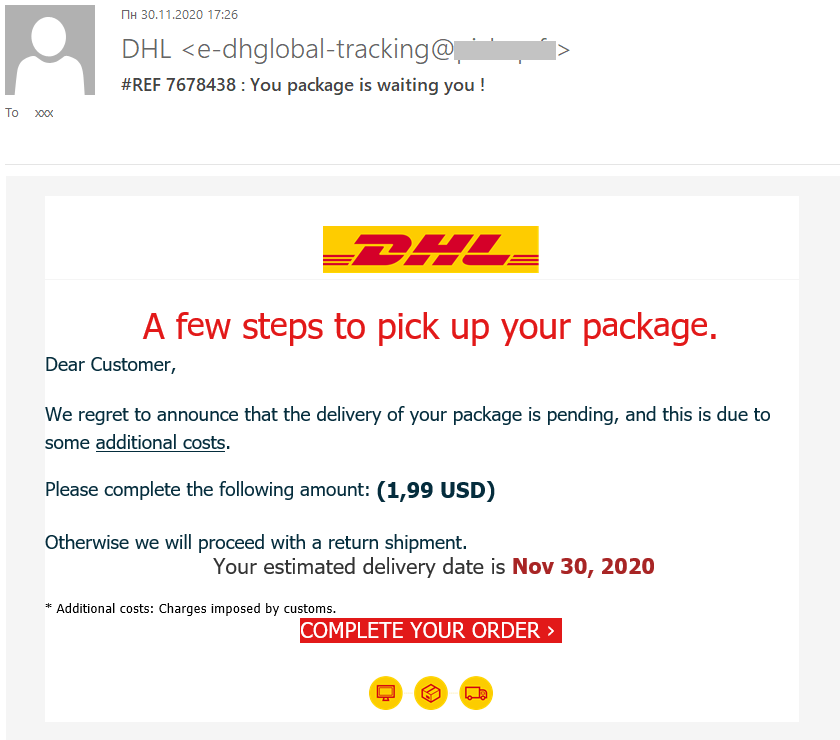

Article on Predatory Lending Methods Directed at Members of new Armed Pushes in addition to their Dependents

November 4, 2024

Endnotes

2 So it part is meant to stress specific key specifications out of new MLA and its particular implementing regulation; but not, this is simply not meant to offer an thorough summary.

5 80 Given. Reg. 43560 (); the latest DOD even offers blogged an interpretive code delivering additional records details about compliance on amended regulation. 81 Given. Reg. 58840 ().

6 79 Fed. Reg. 58602, 58610 (); look for as well as 15 U.S.C. 1601 ainsi que seq. (TILA) and you can several C.F.R. area 1026 (Control Z).

8 But not, this new DOD has revealed that a keen overdraft provider generally would not be protected while the credit rating given that Control Z excludes off loans charge’ people charge enforced because of the a creditor getting credit lengthened to invest an item one overdraws a valuable asset account as well as that your debtor pays one commission otherwise charges, until the newest fee of such something as well as the imposition away from the price tag otherwise charge was indeed in past times decided written down. (Emphasis additional.) 80 Fed. Reg. 43560, 43580 (). Come across as well as the very first interpretative question and answer within 81 Fed. Reg. 58840 ().

15 thirty two C.F.R. 232.3(i). The word collector also contains a keen assignee off a man engaged in the market regarding extending consumer credit with respect to one credit rating lengthened.

The latest exception to this rule having real charges doesn’t apply at costs based on application of a periodic speed, borrowing insurance costs, or to charge getting borrowing-related supplementary affairs

20 Sections (c) and you will (d) from Controls Z permit the ways out of calculating the fresh new Annual percentage rate lower than several situations, instance (1) in the event that financing charges is decided only by making use of you to otherwise alot more unexpected prices; (2) if the loans charges throughout a billing years was otherwise has a predetermined or any other charges that is not on account of app off a periodic price, besides a fee when it comes to a certain exchange; and you can (3) when the fund costs through the a billing cycle are otherwise boasts a fee in accordance with a certain deal into the charging you stage. 12 C personal loans in Hudson.F.Roentgen. . Continue Reading

HELOC compared to Domestic Equity Mortgage: Whats the real difference?

October 9, 2024

Discover the significance of your house owing to household collateral fund or family collateral lines of credit (HELOCs). See the North Dakota payday loans variations as well as your choices for credit.

Report on HELOC and you will Domestic Collateral Loans

HELOCs and you may domestic security finance jobs in different ways, but one another utilize the collateral of your property given that security to help you make it easier to safer financing to support a home repair, higher education, a crisis bills, or even combine high-attract loans.

Guarantee steps industry value of your home as compared to your home loan. Eg, when your home is really worth $eight hundred,000 along with your financial balance are $2 hundred,000, you have $two hundred,000 or 50% equity of your property. Equity constantly stimulates throughout the years since you pay your own financial otherwise improve the worthy of of your property and that’s the answer to securing good HELOC or domestic equity loan. Continue Reading