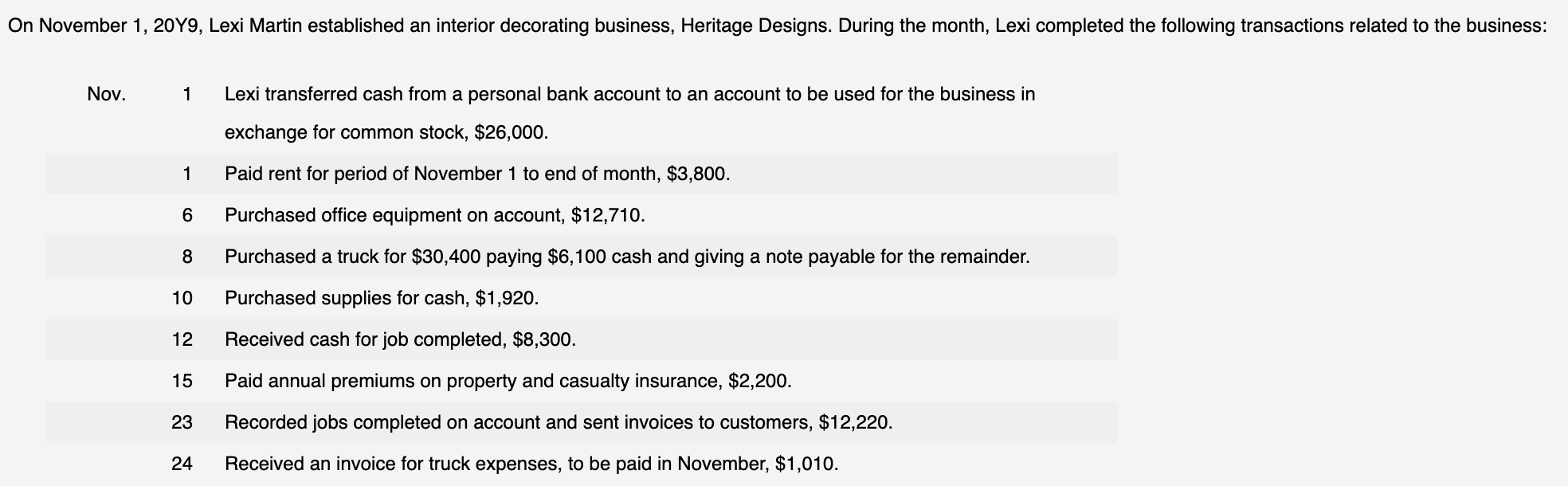

Category: wha is cash advance

As long as i be able to support the possessions to own ?150,000, we do have the bucks to blow the newest auctioneer

December 6, 2024

The house alone has also in order to satisfy a mortgage lender’s conditions with respect to what it is crafted from and the county its in the

Our company is curious just how easy it might be to own your locate home financing while there is income tax effects

Q Merely questioning if you’re able to let settle an issue out of permitting our very own young man to get a home. Continue Reading

Things to Learn about Champion Household Software to possess Military

November 27, 2024

Dining table out of contents

Your responded the decision to make the greatest lose, but that shouldn’t have to be sensible housing. Once you or your wife is within the armed forces, you’ve got adequate on your dish to consider. Seeking purchase a home feels such as a unique amount of stress piled at the same time.

Hero Domestic Programs extend towards armed forces and their family members to obtain on the household of your dreams versus breaking the bank. We assist you so you’re able to get the best financial loan, just the right domestic, and continue maintaining more funds in your pocket.

Here we shall experience all you need to realize about taking lenders getting military family members, the sorts of financing readily available, how to get you to definitely, as well as how Character House Applications might help. Continue Reading

The basics of Increasing the benefits of a house Security Range regarding Borrowing from the bank (HELOC)

November 22, 2024

The basics of Improving the benefits of a house Equity Line out-of Borrowing from the bank (HELOC)

The newest 12 months try upon united states, and be thinking you to now’s the best go out to buy your property. Should it be a kitchen area remodel, a ceiling replacement for or perhaps the inclusion of a patio, the number of choices is actually endless. But not, exactly what actually unlimited is the economic function you will want to promote assembling your project to help you fruition.

Thank goodness, some financial institutions give a selection of financial support choice permitting you to determine the the one that aligns greatest along with your requires and you can endeavor range. Furthermore, current rates of interest result in the expose a keen opportune time for you to safe a loan.

A property Equity Personal line of credit (HELOC) is actually a credit line secured by the family. It permits you to definitely borrow cash getting larger expenditures or even to consolidate large-interest-price obligations off their loans instance playing cards. Continue Reading

Depositors was indeed hoarding bucks and you will forty-eight says had both declared a beneficial statewide bank getaway otherwise limited deposit distributions

November 7, 2024

This new banking getaway endured until February 1315, according to the bank’s location

Chairman Franklin D. Roosevelt declares https://paydayloancolorado.net/stonewall-gap/ a national bank getaway. Once out of his inauguration to your February cuatro, the new bank operating system was at over disarray. Continue Reading

What is the 1st step in taking right out home financing?

November 3, 2024

Obtaining a mortgage will be filled up with suspicion and you may also fear – Our company is here to displace that with comfort.

Purchasing your earliest house is new think of of numerous Australians. However it is as well as a critical union that requires right structuring and you will information to be done loans Hobson City correctly.

Of creating an authentic funds to finding a home loan that is right for your book financial products, it’s not hard to feel purchasing your ideal house is a keen hopeless task.

Finding the best mortgage for you doesn’t have to be daunting otherwise terrifying. We are right here to show one doing. Continue Reading

There is explained the general rules based on how cosigned and you can co-borrowed loans jobs

October 31, 2024

However, often those people guidelines time the fresh windows, especially if there clearly was a pre-present agreement positioned, particularly a divorce decree, a beneficial prenuptial agreement, or even merely good handwritten and you will signed agreement.

Particularly, considering Tayne, a common analogy having car loans inside cases of divorce happens when a wife and husband broke up. Practical question gets who has responsible for [make payment on financing] and having keeping the car, and there is a couple more edges of the. There can be new separation edge of it, therefore the courtroom front side. They generally actually can not score things refinanced, and yet one other accounts for it.

Therefore, such as for instance, as the splitting up decree might tell a-stay-at-home mate in order to refinance the car loan in their own personal title, they may not actually have the ability to. Continue Reading