Category: payday advance loans bad

Many loan providers play with a benchmark regarding 80% LVR getting home loan applications

October 18, 2024

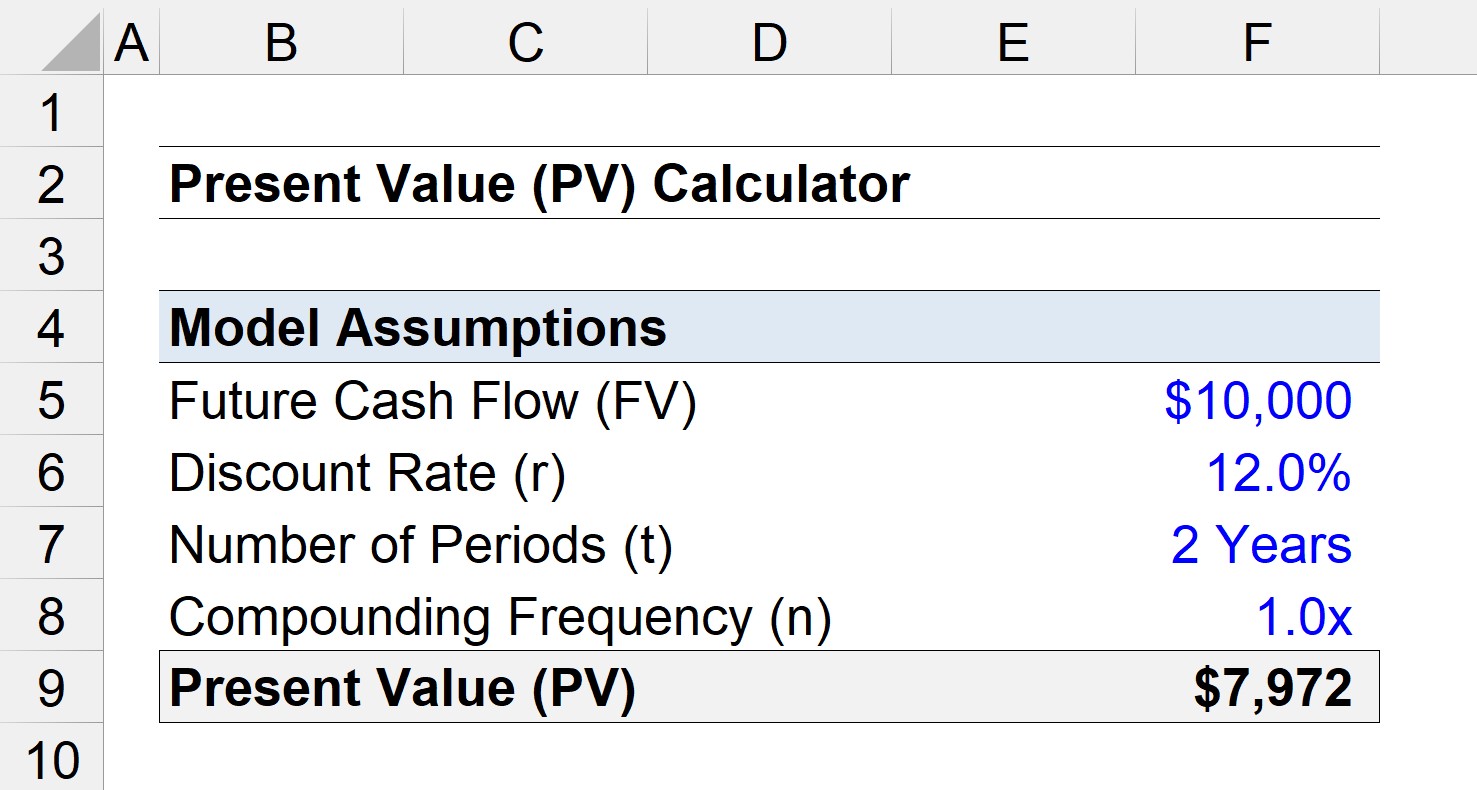

Once a loan provider features analyzed your income and costs, they’re going to know what you can afford based on your current issues. Although not, your position can alter during the a home loan, thereby can also be the pace. For this reason, the Australian Prudential Controls Power (APRA) enforces good serviceability buffer out of 3%.

So it shield form loan providers need certainly to evaluate whether or not you really can afford a good home loan in the event the interest levels raise because of the step three%. Including, for people who sign up for that loan with an effective 6% rate of interest, lenders have to test that you could nevertheless pay the mortgage with good nine% interest.

Put and you will mortgage-to-worth ratio

Of several lenders explore that loan-to-worthy of payday loans Lamont ratio (LVR) to evaluate exposure and discover just how much you really can afford so you’re able to borrow whenever trying to get home financing. Continue Reading

Credit Alert Entertaining Voice Impulse System (CAIVRS)

October 1, 2024

Assumability

When a resident exactly who ordered their residence as a result of an enthusiastic FHA financing wishes to sell it to another people, FHA mortgage regulations allow the the manager when planning on taking along side mortgage payments due by basic proprietor. This particular feature can lead to several thousand dollars inside deals on this new closure price of your order with the new customer.

The consumer will get enjoy reduced interest levels than they would have to pay with the a unique mortgage, and you can providers you will offer their homes less than just they if not you will was in fact in a position to.

Cons out-of Taking out fully FHA Fund

Whenever you are there could be lots of advantageous assets to FHA funds, they’re not a perfect complement visitors. You’ll find disadvantages also. When deciding on between antique and FHA money, this type of bad facts are essential to take on.

Usage Limits

This new FHA loans enjoys constraints by what consumers loans Ballplay Alabama are allowed to purchase, which do not occur which have antique financing. You simply can’t, particularly, fool around with FHA loans to order investment attributes or next residential property.

The latest logic about such restrictions will be to ensure the function of the new FHA – making it simple for lower in order to center-income earners to own their unique house instead of increase the already rich accumulate a lot more.

Mortgage Insurance coverage Costs

The latest advanced money one consumers need to pay if they have FHA finance try seemingly more than those who feature traditional loans. These Financial Insurance premiums (MIP) is actually energized with the yearly premium, that is always 8.5% of your own mortgage balance but really becoming paid. Brand new MIPs are labelled at 1.75% of your own loan’s complete amount, which can be set in the mortgage otherwise paid in bucks and you will continue for the loan’s life. Continue Reading