Category: loan payday loans

Indiana Virtual assistant Loan Program and you can Mortgage Conditions

November 20, 2024

Indiana Va Mortgage: Ways to get A Virtual assistant Loan in Indiana

If you have served from the army, you might make use of a beneficial Va mortgage when selecting a home. The fresh Institution of Veterans Situations provides registered lenders to offer loans considering its regulations. That it decreases the risks to the financial once the loan is actually protected of the Va.

The benefits of Having fun with a Virtual assistant Financial in the Indiana

There are many different attractive reasons to consider utilizing good Va mortgage for people who meet the requirements. The biggest great things about this financing program is:

No Downpayment

Should you want to you might fund 100% of cost of the home. So long as our home appraises towards expected well worth you can choose to cease saving to https://paydayloancolorado.net/piedra own a deposit.

Without having to save your self having a down-payment, its smoother and you can reduced to buy property. Rescuing a large down payment can take customers years, but to be able to fund 100% of the cost of our home can make this program most glamorous.

Much easier Recognition

Due to the fact Virtual assistant doesn’t impose the absolute minimum credit rating requirement, loan providers can probably. Lenders do this to reduce risk, but not surprisingly, it is essentially better to qualify for an effective Virtual assistant mortgage even in the event you got financial items in the past. Continue Reading

What credit rating is perfect for to get a house?

November 15, 2024

Good credit so you can safe a mortgage loan will be no less than 650.

Your credit rating signals your creditworthiness, and if you happen to be to purchase property, the rating can mean much inside determining the borrowed funds, the rate, in addition to savings you are provided.

- Getting a normal home loan, it is essential to have a credit history with a minimum of 620. Continue Reading

Combining Financial obligation and you will Financing with a high Financial obligation-to-Earnings Ratio

November 4, 2024

If you find yourself caught with a high debt-to-money proportion, some think it’s tough to be eligible for a debt settlement financing. Think alternative methods to settle the issue, also merging using a financial obligation government system.

Options for Large Personal debt-to-Income Ratio Personal debt

Debt consolidation was combining multiple costs into that high debt you to definitely try repaid which have that loan or financial obligation-rescue system that has a whole lot more positive rates of interest and you may a lower payment per month.

A debt negotiation financing off banking institutions, credit unions otherwise on the internet debt consolidation reduction lenders is among the most preferred sorts of debt consolidation reduction, but lenders was reluctant to promote money so you can consumers which have an effective highest loans-to-earnings ratio (DTI).

Users with a high DTI are believed an extreme risk therefore even if you try acknowledged for a loan, the interest rates and you will monthly payments could well be so high you to it’s not convenient.

It could be difficult to find a debt settlement financing in the the pace you adore, however, there are methods around the disease. Almost every other financial obligation-rescue solutions, like an obligations management program, can help you consolidate the debt without the need to take out a premier risk loan.

What’s a leading Loans-to-Income Proportion?

Debt-to-earnings (DTI) is a tool one lenders used to level what portion of your earnings visits paying bills and you may whether there will probably be adequate money kept each month to repay yet another loan.

The debt money ought to include prices for housing, resources, vehicles, student and private fund, alimony or youngster money and you will lowest number owed into credit cards. Continue Reading

Do you have to Re-finance To remove Anybody From A home loan?

November 4, 2024

Introducing our very own writings! Today we are sharing the question regarding whether you need to refinance to eradicate somebody from a mortgage. That is a significant question for the majority people, household, or other communities who will be given taking right out a mortgage to one another, and we need to make sure you are aware all ramifications regarding signing a loan to each other. We will talk about the possibility benefits and drawbacks off refinancing managed to remove somebody of a mortgage, along with other alternatives for to make alter in order to a shared mortgage. Continue reading more resources for it important choice.

Refinancing a mortgage to remove individuals about financing isnt usually necessary. The decision to refinance relies on the challenge as well as the certain conditions of one’s lender.

Do you have to Re-finance To eliminate Some one From A mortgage?

In general, if your person being put into the loan is actually someone otherwise companion, odds are the loan is going to be changed in place of refinancing. Continue Reading

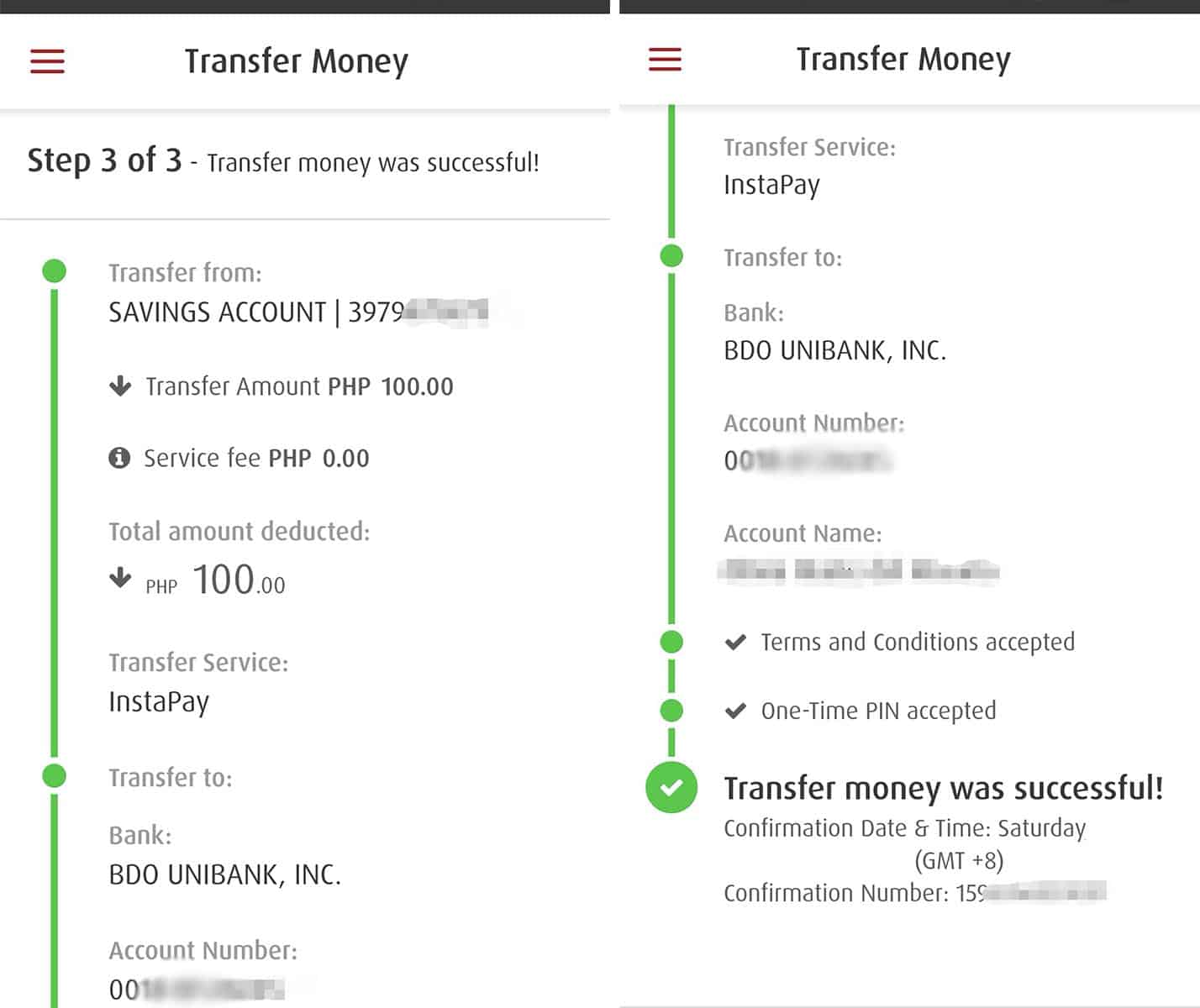

How-to upload a cable tv transfer having mobile financial

October 11, 2024

Checking Membership

Buy the checking account that actually works right for you. Get a hold of our very own Chase Total Examining promote for new customers. Go shopping along with your debit credit, and you can bank regarding almost anywhere by the cellular proceed this link here now telephone, tablet otherwise desktop and more than fifteen,000 ATMs and more than cuatro,700 branches.

Discounts Account & Cds

It’s never too soon to start rescuing. Unlock a bank account or unlock a certification off Deposit (discover rates) and start saving your money.

Handmade cards

Chase playing cards makes it possible to purchase the what you want. Continue Reading