Category: cash advance loand

We applied on the web to help you Ally Lender because they did definitely promote an effective

November 6, 2024

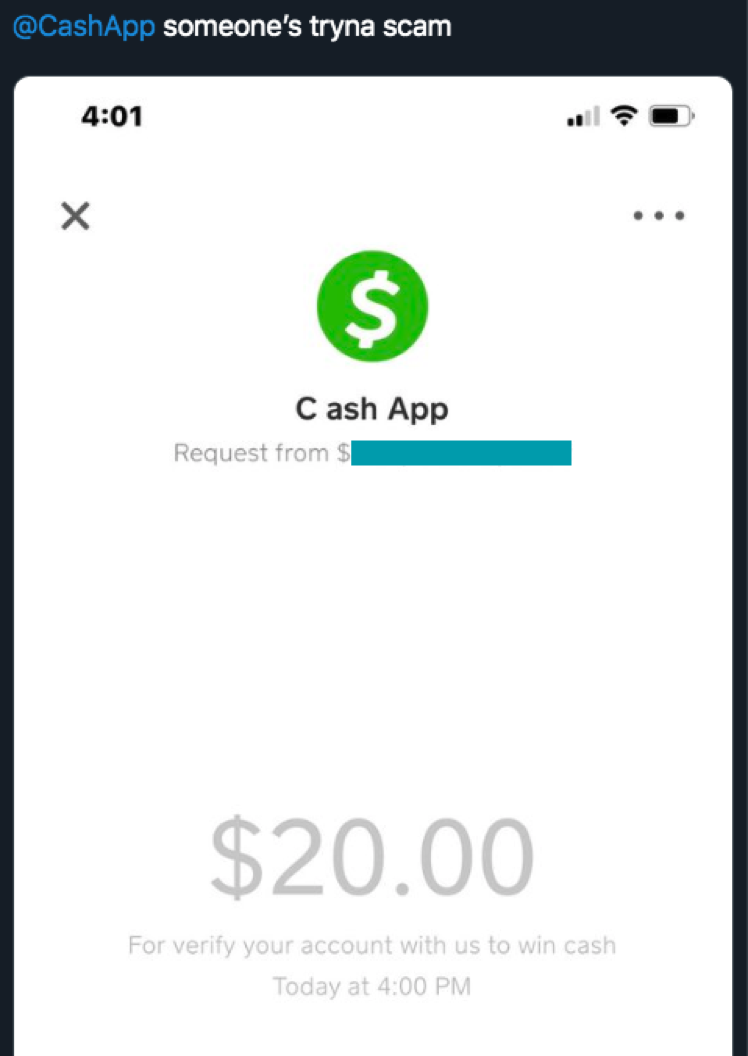

Things were going decent which have Ally up to a sad sequence regarding incidents occurred. I became a prey away from swindle (We take complete duty). Ally, because fundamental process, lay an excellent stop on my membership. Definition I can perhaps not receive money out, place profit, transfer money to my soon owed charge card, create people monitors, otherwise use costs shell out. It is understandable, however, what’s Perhaps not understandable is the fact that it took 5 days to track down someone towards cellular phone to talk to myself and you may eliminate the difficulty. If you ever suffer from Maureen, your woman responsible for currency loss and you can con avoidance, the action was awful. Maureen calls myself straight back a short while immediately following talking-to you to definitely regarding her lovers exactly who in the end cleaned my personal be the cause of use and you may informs me that we in the morning a threat. When questioned https://paydayloanalabama.com/abbeville/ why she said one to recommendations can’t be unveiled. We will see so you can terminate your bank account and you also dont open an alternative one. So you should be cautioned that if ripoff otherwise a fraud previously happens to your, they will not have your straight back. They will not help you, doesn’t cause you to feel that the money is secure, and they’re going to Perhaps not remove you in accordance. They will certainly miss you with no condition-able reason due to the fact a buyers. Once i checked out user reviews I imagined this type of extraneous situations you to triggered that it bank to get terrible won’t affect me. Works out it did, and i honestly regret beginning a bank checking account with them. Browse in other places.

Ally Bank was a fraud

What is the section of experiencing a joint Membership should your mate you should never alter the target. Continue Reading

Debt needs could be assessed and you can met with Peoples Financial & Trust’s simple and easy smoother financing solutions

November 4, 2024

Betty O., Springfield

The brand new PBT group are the best group to do business with. Our company is very pleased for the a great elite services brand new provide.

User Unsecured loans

You have made the choice to get otherwise refinance an automobile, make some renovations otherwise realize almost every other demands or wants you got with the a would you like to number. The Individual Banker during the Peoples Bank & Believe is prepared and ready to walk you through the process out-of credit money to discover the work complete. Having device have eg aggressive rates of interest, basic smooth apps, single banker work plus, we are going to help to attain your aims. (Financing Money Susceptible to Borrowing Approval)

Consumer Loans to own auto, motorcycles, boats, entertainment car, etc.

You can expect the traditional unsecured loan items thus whether it is go out to possess a separate automobile otherwise renovations, i succeed easy. Check out of benefits you get whenever choosing Peoples Bank & Trust:

- Form of terms readily available with regards to the kind of unsecured loan

- Aggressive Interest rates and you may costs

- Assistance with all of our easy software process

- Automatic checking/deals deductions

- Effortless attract

- Zero prepayment costs

Certification away from Deposit Fund

You need cash now, your certificate out of put doesn’t adult for another 12 months and you also don’t want to spend the money for punishment to have early detachment? Continue Reading

Accepted Render Data files Necessary for Mortgage Recognition

November 4, 2024

- Provide your own last 2 yrs Notice away from Tests (NOA) in the Canada Money Department and even more documents such as the new Report away from Team Affairs.

- When you yourself have almost every other types of income such as area-day really works, rental money, or a retirement then your lender you certainly will request back-right up files. Be ready to confirm your revenue and have the bank review their tax statements, duplicates away from paystubs, or tenancy plans.

As to the reasons Your credit rating is very important

The lender will have to check your credit history and you will opinion your current financial obligation. A great good score is recognized as being 680 otherwise a lot more than. That have a get above 680 you will be eligible for An even lenders such as for example a primary lender, and this get access to the best interest levels considering. Continue Reading

Really broadly speaking, discover a number of points that might happen if you standard on the a loan

October 31, 2024

- History, compensatio morae is additionally called mutual default. It describes a situation in which both borrower and you can creditor are in default when you look at the mutual loans. For instance, for the a sale package, in case the merchant doesn’t provide the items plus the buyer doesn’t pay the rates, both at the same time, this could be compensatio morae.

These types of principles are important inside the determining responsibility and you will remedies within the contractual disputes. Inside civic legislation cases, these three decide which people is at fault, to what education, and you can what consequences will be realize.

Standard Effects out of Defaulting

The ensuing list would depend not just with the particular financing you may be defaulting with the your credit rating, internet well worth, quick assets, and you may legal reputation with your financing deal. We shall view far more particular effects of defaulting toward particular products out of debt afterwards.

- Credit score Ruin: Defaulting into loans you may really impression your credit rating. Later money and defaults is said to help you credit agencies and will remain on your credit history for approximately 7 age. Continue Reading

Individuals of all types paused repayments, and many performed thus having far longer than that they had 1st structured

October 31, 2024

Immediately following deferments and you will forbearances: Every delinquent attention at the end of that or a series https://paydayloancolorado.net/twin-lakes/ regarding successive deferments or forbearances was put into the principal. For example outstanding appeal one to accrued one another over the course of frozen percentage and you may before repayments were paused.

Income-determined payment: Every delinquent appeal capitalizes whenever individuals alter, get-off, or getting ineligible to possess smaller money significantly less than an income-motivated installment bundle.

And lots of stated that servicers applied forbearances retroactively to bring membership most recent, as they processed money-inspired plans and other financing-relevant programs, otherwise if you’re individuals spent some time working add required paperwork

Integration and you may standard: At exactly the same time, unpaid notice along with capitalizes when borrowers consolidate or standard to their fund. Continue Reading

The amount of money can i acquire to possess a home loan?

October 6, 2024

Income and you may Expenditures

Your income and expenses will get an impact on how much cash you could borrow. A very good track record of a job and you will a track record of normal offers on the savings account helps it be simpler for you locate a mortgage. Lenders like to see proof of an excellent financial management, to ensure they’re not providing so many dangers. This can be done that with another checking account with a top interest and come up with typical places and limited distributions. *

Lenders will need into account any kind of funds you’ve got and you may the fresh new costs of the such money. Together with which, loan providers will generally examine financial comments going back about three to 6 months when examining an application. This means it’s important to keep family savings in order, ensure there are no late money and therefore your account doesn’t get overdrawn.

Credit score

Most lenders will do a credit report look at as part of an application. The details in your credit rating file can indicate the difference ranging from which have that loan approved or not. Your credit history have a tendency to checklist one era for which you enjoys used to possess borrowing, the outcomes of those apps and you will one borrowing from the bank default recommendations joined of the a third party. You can examine your credit score through credit bureaus including Equifax Pty Ltd (equifax.au).

2. Their home loan repayments

From the running around with calculators, it is possible to think how much youre safe expenses for every month within the home loan repayments. Think about, it’s important to not simply build your home loan repayments conveniently per month, but to have enough money to own emergencies otherwise unexpected will cost you.

Our home loan repayment calculator makes it possible to imagine the genuine prices of your pick. Continue Reading