Category: Bookkeeping

Definition of Loss Accounting terms

May 17, 2021

Income Taxes reflect this share, serving as a reminder that not all earnings translate to net profit. When this figure grows, businesses know they’re onto something; when it dwindles, it’s a clarion call to introspection. Our website services, content, and products are for informational purposes only. Losses from a lawsuit are generally recorded before the actual payment is made. This is because the loss from a lawsuit is normally recorded based on an estimate when the loss is considered probable to happen.

What are the three core documents that measure a company’s performance?

Dividends constitute another aspect of shareholder returns that can take a hit. Companies that regularly pay dividends may opt to reduce or eliminate them to preserve cash amidst tough financial conditions. This may disappoint income-seeking investors who rely on regular dividend payouts. This is recorded by making a debit entry to the account titled “Bad Debts Expense” and a corresponding credit entry to the “Allowance for Doubtful Accounts” account. In financial accounting, the treatment and recording of losses vary depending on the nature of the loss.

Types of P&L Statements

If you prefer to opt out, you can alternatively choose to refuse consent. Please note that some information might still be retained by your browser as it’s required for the site to function. Skylar Clarine is a fact-checker and expert in personal finance with a range of experience including veterinary technology and film studies. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise.

Gains and Losses vs. Revenue and Expenses: What’s the Difference?

Clubbing them with regular income or expenses can paint a distorted image of business health. However, Gross Profit doesn’t account for other expenses that companies incur. Yet, it’s essential as it offers an initial glimpse into the efficiency of the production and pricing processes.

What is the purpose of a Profit and Loss Statement?

Other businesses, such partnerships, are flow-through entities, which require the owners to report and pay taxes on their share of the business’ income. Capital losses sustained during the year must be first used to offset other capital gains. If capital losses exceed any capital gains made during the year, only a portion of it may be used to offset other taxable income.

In economics, when an agent is risk neutral, the objective function is simply expressed as the expected value of a monetary quantity, such as profit, income, or end-of-period wealth. For risk-averse or risk-loving agents, loss is measured as the negative of a utility function, and the objective function to be optimized is the expected value of utility. “Loss”, sometimes referred to as “Loss.jpg”,[1] is a strip published on June 2, 2008, by Tim Buckley for his gaming-related webcomic Ctrl+Alt+Del.

- Still different estimators would be optimal under other, less common circumstances.

- Losses adversely affect the stock prices, and the shrinking of market capitalization might even instigate a vicious cycle of devaluation.

- Insurance serves as a strategic tool for businesses to manage financial losses by transferring risk to a third party.

- All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

- There’s a fundamental accounting principle, known as the matching principle, which requires that losses be matched with revenues in the period they are incurred.

It is also used to refer to several periods of net losses caused by expenses exceeding revenues. A profit and loss statement, also called an income statement or P&L statement, is a financial document that summarized the revenues, costs, and expenses incurred by a company during a specified period. They decrease the assets, increase the liabilities, or reduce the overall equity of a company. There’s a fundamental accounting principle, known as the matching principle, which requires that losses be matched with revenues in the period they are incurred.

The reason behind this is that any changes in revenues, operating costs, research and development (R&D) spending, and net earnings over time are more meaningful than the numbers themselves. For example, a company’s revenues may grow on a steady basis, but its expenses might grow at a much faster rate. A profit and loss statement, also called an income statement or P&L statement, is a financial document that summarizes the revenues, costs, and expenses incurred by a company during a specified period. The ability to carry losses not only forward to offset future profits, but also backward to recoup previously paid taxes, allows businesses to maximize their tax efficiency. By using these tools, companies can align their tax strategies with their financial goals, creating a more effective plan for growth and profitability.

Explore strategies for handling financial losses in business, including accounting practices, insurance roles, and reporting obligations for a robust fiscal approach. Yet another example would be of a company that sells frozen foods and needs to pay for who files schedule c: profit or loss from refrigerated storage facilities, utility costs, taxes, employee expenses, and insurance. If sales are slow, the company will need to hold onto its inventory for a longer time, incurring additional carrying costs which could contribute to a net loss.

This accounting treatment can provide a financial cushion, as it may reduce the tax burden in profitable years. Companies must adhere to the tax laws governing the carryover of losses, which vary by jurisdiction. Financial losses are an inevitable aspect of running a business, and their management is crucial for long-term sustainability. These losses can stem from various sources such as operational failures, market downturns, or unforeseen events, impacting the financial health of a company.

THE BEST 10 Bookkeepers in NEW YORK, NY Last Updated July 2024

May 11, 2021

Take the guesswork out of your business’s finances and hire New York’s most trusted bookkeeping experts today. From bookkeeping and payroll services to financial reporting and business insights, BooXkeeping is your all-in-one solution to make managing business finances easy. Our bookkeepers have years of experience and are experts in bookkeeping for businesses of all sizes. Discover how we can help you have better finances with a personalized demo from a Bench expert, ready to answer all your questions. Sign up as a customer today and get a free month of bookkeeping, valued at $299. With Bench, you get a team of real, expert bookkeepers in addition to software.

- This feature saves you the time and effort of manually uploading documents.

- BooXkeeping is a nationwide provider of affordable outsourced bookkeeping services to small and medium-sized businesses.

- We support and work with most major accounting and bookkeeping software platforms, making it easy to outsource to us and keeping you in control of your financial data.

- If there’s any change in your bookkeeping team, we’ll let you know as soon as possible and make sure the transition is a smooth one.

- In the hustle and bustle of New York City, New York, where small businesses span diverse sectors from retail to hospitality, Bench Accounting provides a pioneering approach to online bookkeeping.

Frequently Asked Questions

We provide easy-to-understand financial statements and reports that give you visibility into your business’s finances so you can make informed decisions and grow your business. Ensuring that your employees are paid on time and accurately is critical to retaining top talent and keeping your business running smoothly. We try our best to keep you with the bookkeeping team you’re assigned when you come on board. If there’s any change in your bookkeeping team, we’ll let you know as soon as possible and make sure the transition is a smooth one. Our team takes the time to deeply understand your business, answer your questions, help you link your accounts, and show you how Bench works. Finding the right bookkeeping service in New York shouldn’t be difficult.

Search bookkeeping services in popular locations

Our platform allows you to automate data inputs from most major providers to avoid common mistakes. We partner with merchants like Gusto, Stripe, Shopify, and Square—so your finances are always accurate. Schedule a free, no-hassle, no-obligation consultation with us and find out how much time and money we can save your New York-based business today.

LUMA Hotel – Times Square

At Bench, we truly understand the competitive nature of business in New York City, and the importance of accurate and time-saving bookkeeping in accelerating your business growth. Our expert team is not just proficient in bookkeeping, https://www.bookstime.com/articles/cash-flow-from-financing-activities but they are also well-versed in local New York tax laws and understand the ins and outs of taxes specific to your industry. Experience a novel way of handling your bookkeeping with Bench—we’ve got your NYC business covered.

- The end result is a set of accurate financial statements—an income statement and a balance sheet.

- Each month, your bookkeeper organizes your business transactions and prepares financial statements.

- We understand the importance of accuracy when it comes to bookkeeping.

- BooXkeeping will make running your business in New York smoother than ever with our team of U.S.-based experts handling day-to-day bookkeeping tasks and integrating seamlessly into your existing accounting software.

- Bench is proud to offer bookkeeping services to businesses across the United States.

- We provide easy-to-understand financial statements and reports that give you visibility into your business’s finances so you can make informed decisions and grow your business.

- Discover how we can help you have better finances with a personalized demo from a Bench expert, ready to answer all your questions.

- We offer affordable bookkeeping services so you can keep your business running smoothly without breaking the bank.

- Get your bookkeeping, income tax prep, and filing done by experts—backed by one powerful platform.From startups to agencies, Bench works with New York City small businesses.

- All your monthly bookkeeping tasks are handled for a low fixed monthly rate with no long-term contracts.

- Sign up as a customer today and get a free month of bookkeeping, valued at $299.

We make it easy to get the help you need so you can focus on running your business with confidence, knowing your bookkeeping is in good hands. We’ll work with you to connect accounts and pull the data we need to reconcile your books. Each month, your bookkeeper organizes your business bookkeeping services near me transactions and prepares financial statements. All your monthly bookkeeping tasks are handled for a low fixed monthly rate with no long-term contracts. As a small business owner, you have enough to worry about without having to keep track of your bookkeeping and finances.

Frequently Asked Questions and Answers

You’ll always have the human support you need, and a mobile friendly platform to access your up-to-date financials. Shortly after you sign up, we’ll give you a call to learn more about your business and bookkeeping needs. On this call, we’ll connect your accounts to Bench, and gather any extra documentation we need to complete your books.

Globaldesk Bookkeeping & Taxes

Solved: What’s the difference between quickbook balance and bank balance of the bank register?

April 1, 2021

Or there may be a delay when transferring money from one account to another. Or you could have written a NSF check (not sufficient funds) and recorded the amount normally in your books, without realizing there wasn’t insufficient balance and the check bounced. If you use the accrual system of accounting, you might “debit” your cash account when you finish a project and the client says “the cheque is going in the mail today, I promise! Then when you do your bank reconciliation a month later, you realize that cheque never came, and the money isn’t in your books (even though your bookkeeping shows you got paid). Bank reconciliations aren’t limited to just your bank accounts. Any credit cards, PayPal accounts, or other accounts with business transactions should be reconciled.

- Most businesses ask for their bank statement at the end of each month.

- This is to confirm that all uncleared bank transactions you recorded actually went through.

- Once you’ve identified the issues, you can fix them accordingly.

- Book balance and bank balance are two distinct figures that often require careful examination to ensure financial accuracy.

- If there weren’t enough funds on a check that was part of a deposit, the bank would take the money from the business’s checking account.

- This balance is updated by the bank depending on deposits, withdrawals, and other transactions.

- John, based in Austin, Texas, is the author of The Stripped-Down Guide to Content Marketing.

Month-end Procedure

The book balance and the bank balance of a corporation, however, might diverge in a number of circumstances. Balancing of books holds major significance for all companies or small business owners. You can easily ascertain bank balance vs book balance the financial status of your company or business when you keep an accurate bookkeeping system. Balancing the books may sound daunting and exhausting task, but it is highly crucial for larger or small businesses.

Submit to get your question answered.

Those debits would not be recorded in the book balance until the month-end numbers are reconciled with the bank. For this reason, the only recourse is to prepare a statement to reconcile the balance shown by the cash book to the balance shown by the bank statement. Except for the above fact, under normal circumstances, if both the bank and account holder have kept their books properly, the cash book and the bank statement should show identical balances. One reason for this is that your bank may have service charges or bank fees for things like too many withdrawals or overdrafts.

Adjustments and Errors

Look for an entry in your account called “ending balance,” “previous ending balance,” or “beginning balance.” Enter this figure on your form or spreadsheet. Statement unless the un-presented checks have been presented, or the uncollected checks collected. Please feel free to reach out if you have any other questions about the balances in QuickBooks.

Reasons for Difference Between Bank Statement and Company’s Accounting Record

While a checking account generally comes with a debit card that can be used at an ATM, a savings account normally doesn’t offer a debit card but might provide an ATM card. Neither card may do you much good if your financial institution has limited access to an ATM network. This will ensure your unreconciled bank statements don’t pile up into an intimidating, time-consuming task. When you do a bank reconciliation, you first find the bank transactions that are responsible for your books and your bank account being out of sync.

- Banks may charge fees for various services or offer interest on account balances, which might not be immediately recorded in the company’s books.

- While the bank balance is solely determined based on the transactions on the register.

- Reconciling your bank statements lets you see the relationship between when money enters your business and when it enters your bank account, and plan how you collect and spend money accordingly.

- Therefore, until the clearing procedure is finished, the funds—known as float funds—are temporarily added twice.

- These adjustments ensure that the company’s records accurately reflect the bank’s charges and credits.

- Any credit cards, PayPal accounts, or other accounts with business transactions should be reconciled.

Cash Book and Bank Statement FAQs

I have verified/reconciled all transactions and checked for any pending and still can’t get the balances to match. It seems as though the balances should match at all times assuming the bank transactions are being downloaded daily. Therefore, the bank credits the account holder’s personal account, and the entry appears in the Cr.

- These deductions would be reflected in the book balance while not yet reflected in the bank account balance.

- For example, the bank statement may reveal that a bank service charge was withdrawn from the account on the last day of the month.

- The cash book balance includes transactions that are not represented in the bank balance.

- The difference between book and bank balance can come from many sources.

- That is to say, the amount of the balance will be the same while it is on different sides of the ledger.

Paycor Login | Employee Login

solara executor

galaxy swapper v2

rufus download

Paycor Login

Understanding What is a Ledger in Accounting: Your Guide to Ledger Accounts And More

December 10, 2020

Ask a question about your financial situation providing as much detail as possible. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, understanding depreciation and balance sheet accounting and many others.

Which of these is most important for your financial advisor to have?

Recording transactions in multiple ledgers also serves as a control for accountants. For example, when money is received by a business, the transaction would be recorded is bookkeeping hard everything you need to know both in the sales ledger as well as in the sales ledger control account contained in the general ledger. In this ledger account example, these should be identical entries to maintain balance. Whether you own a cake shop or run a landscaping business, as a small business owner, it’s important to have some basic accounting knowledge.

Revenue and Loss Accounts

Basically, a ledger is where all journal entries are being summed up with the specific account names drawn from the chart of accounts used as a heading. Remember, all entries must adhere to the double-entry bookkeeping system, where each transaction affects at least two accounts – one must be debited, and another credited. A cash book functions as both a journal and a ledger because it contains both credits and debits. Because a cash book is updated and referenced frequently, similar to a journal, mistakes can be found and corrected day-to-day instead of at the end of the month.

Would you prefer to work with a financial professional remotely or in-person?

A ledger account is a record of all transactions affecting a particular account within the general ledger. Making sure the diary (journal) and the organized book (ledger) match up is crucial. It’s like checking that every story you first wrote down is correctly placed in its chapter. This ensures the financial health shown in your books is right and true, reflecting all accrued expenses and revenues as per the double-entry system. Then, these stories are sorted into different chapters in the ledger, based on what they’re about, like sales or supplies.

The general ledger is the master chart of accounts where all business transactions are recorded. A sub-ledger, or subsidiary ledger, is a set of intermediary accounts linked to the general ledger that contain transaction information. An asset account covers accounts receivable, cash, prepaid expenses, and fixed assets. Asset accounts are also referred to as real accounts or permanent accounts because they don’t close at the conclusion of the accounting year. Each asset’s account balance is carried forward to serve as the starting balance for the next accounting period.

It starts with small notes, called journal entries, that are checked through a process called a trial balance, ensuring everything adds up right in the financial statements. It’s well worth preparing a ledger to keep track of your transactions and ensure that credits and debits are in balance. If the totals don’t match up, it’s time to refer back to both your original journal entries and accounting ledgers to discover errors or discrepancies.

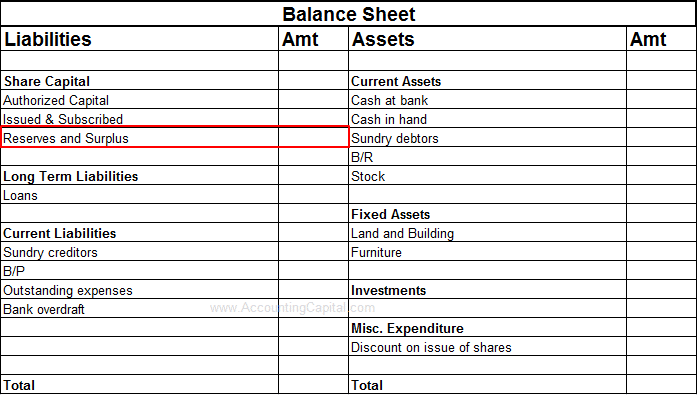

- This information can be used to prepare financial documentation, like balance sheets, income statements, and cash flow statements.

- The details are then summarised into a T format within the accounting ledger book.

- Janet Berry-Johnson, CPA, is a freelance writer with over a decade of experience working on both the tax and audit sides of an accounting firm.

- General ledgers, also referred to as accounting ledgers, are the physical or digital record of a company’s finances.

- This is like adding a new line to the story of your business’s money.

A digital wallet (also sometimes called an electronic wallet) is an application that securely stores digital payment information and password data for a user. We faced problems while connecting to the server or receiving data from the server. Private Ledger consists of accounts which are confidential in nature. See why progress invoicing and receiving partial payments is highly beneficial. GoCardless helps you automate payment collection, cutting down on the amount of admin your team needs to deal with when chasing invoices. Find out how GoCardless can help you with ad hoc payments or cpa vs accountant recurring payments.

Accounting Explained With Brief History and Modern Job Requirements

December 4, 2020

Advancement opportunities may arise after gaining experience, and obtaining the CFA Institute’s Chartered Financial Analyst (CFA) certification can be beneficial. Rather than preparing tax documents or performing audits, a concentration in managerial accounting prepares you to analyze, interpret and communicate data to help leadership make sound financial decisions. This concentration may lead you to pursue a Certified Management Accountant (CMA) designation, and may appeal to students seeking internal accounting roles in the corporate, nonprofit and government sectors. Instead of a degree focused only on accounting, business administration degrees have a concentration in accounting. Pursuing a business administration degree provides students with foundational business knowledge and managerial skills in addition to those in accounting.

Brandon Galarita 1065 instructions is a freelance writer and K-12 educator in Honolulu, Hawaii. He is passionate about technology in education, college and career readiness and school improvement through data-driven practices. If you have an interest in numbers and strong analytical skills, a career in accounting can be a good fit for you. Bookkeeping requires just a high school diploma and a few college courses in accounting to get started.

Do you already work with a financial advisor?

With FreshBooks’ user-friendly cloud-based mobile interface, you can access integrated double-entry accounting features from any device, even on the go. We make it easy to take control of your business and manage your bookkeeping safely, from anywhere. Efficient record keeping and implementing sound financial strategy are the best ways to track your business cash flow patterns. A small business owner who can create financial reports can understand the money coming and flowing out of their organization and will be better able to make smart business decisions in the future. This focuses on the use and interpretation of financial information to make sound business decisions.

What is your current financial priority?

You’ll be able to understand your personal and organizational finances, make the importance of including key personnel in your project more data-driven decisions, and advance your career. While you might think non-accountants don’t need to study financial accounting, an understanding of key accounting concepts, like the accounting equation and financial statements, can be helpful for all professionals. To illustrate double-entry accounting, imagine a business sending an invoice to one of its clients. An accountant using the double-entry method records a debit to accounts receivables, which flows through to the balance sheet, and a credit to sales revenue, which flows through to the income statement.

The reports generated by various streams of accounting, such as cost accounting and managerial accounting, are invaluable in helping management make informed business decisions. Amanda Bellucco-Chatham is an editor, writer, and fact-checker with years of experience researching personal finance topics. Specialties include general financial planning, career development, lending, retirement, tax preparation, and credit. Accounting master’s curriculums help students develop advanced analytical and technical accounting skills and gain comprehensive knowledge bookkeeping software vs accounting software of advanced practice areas in the field. Some schools offer intensive programs, which you can complete in less than a year.

- With a basic understanding of accounting, you can understand what these companies have done wrong and why it matters.

- We also allow you to split your payment across 2 separate credit card transactions or send a payment link email to another person on your behalf.

- 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements.

- This concentration may suit aspiring entrepreneurs and students seeking a broad business skill set.

- Often taking four years, a bachelor’s degree in accounting usually requires a minimum of 120 credits to graduate.

Learning Financial Accounting

An accounting degree prepares you to speak and understand that language, whether you pursue accountancy, auditing, sales management, advising or one of the many other accounting career paths. Accounting helps a business understand its financial position to be able to make informed decisions and manage risks. You can outsource your accounting work to outside professionals who specialize in bookkeeping and tax preparation. Outsourcing can offer many advantages because it allows you to take advantage of specialized skill sets that may not be available when hiring someone in-house. Accounting is like a powerful machine where you input raw data (figures) and get processed information (financial statements).

Frequently Asked Questions (FAQs) About Jobs for Accounting Graduates

All median salaries and projected job growth percentages courtesy of the U.S. Accounting is the process of keeping track of your business’s financial transactions. Organizations utilize financial statements like balance sheets and income statements to make data-driven decisions regarding investment opportunities, budgets, and resource allocation.

Sharp analytical skills provide a strong foundation for an accounting career, allowing professionals to analyze and interpret data accurately and extract valuable insight for strategic business decisions and actions. The primary purpose of accounting is to provide financial information about a business or entity, including its assets, liabilities, equity, income, and expenses. This information helps managers make decisions related to operations, investments, and other activities necessary for running the business successfully. The law requires businesses to maintain accurate financial records of their transactions and share the reports with the shareholders, tax authorities, and regulators. This information is also required for indirect and direct tax filing purposes. Logan Allec is a CPA and the founder of tax relief company Choice Tax Relief, where he represents individuals and businesses who owe significant back taxes to the IRS or their state.