Interest Revenue: Calculation & Formula

June 7, 2024

The IFRS Foundation is a not-for-profit, public interest organisation established to develop high-quality, understandable, enforceable and globally accepted accounting and sustainability disclosure standards. Both financial and non-financial companies can increase their profitability by increasing interest income and cutting interest expenses. On the other hand, interest revenue may not be the primary source of income for different companies, such as automobile companies or electronics companies.

IFRS Accounting

The Motley Fool reaches millions of people every month through our premium investing solutions, free guidance and market analysis on Fool.com, top-rated podcasts, and non-profit The Motley Fool Foundation. It’s also worth noting that this revenue stream has a significant impact on the company’s financial statements. It affects the income statement where it increases total revenue and net income, and it also impacts the balance sheet, contributing to the increase in total assets. Interest revenue is the income earned from the lending of assets, whether it be money, goods or services. The US GAAP policy election simplifies the accounting for sales taxes compared to IFRS Standards, but may yield a different presentation and transaction price when elected. For example, if a company has received $10,000 in interest payments during a particular quarter and accrued another $5,000 in owed interest, then it would report $15,000 in interest revenue under the accrual method.

What Is the Difference Between Interest Receivable and Interest Revenue?

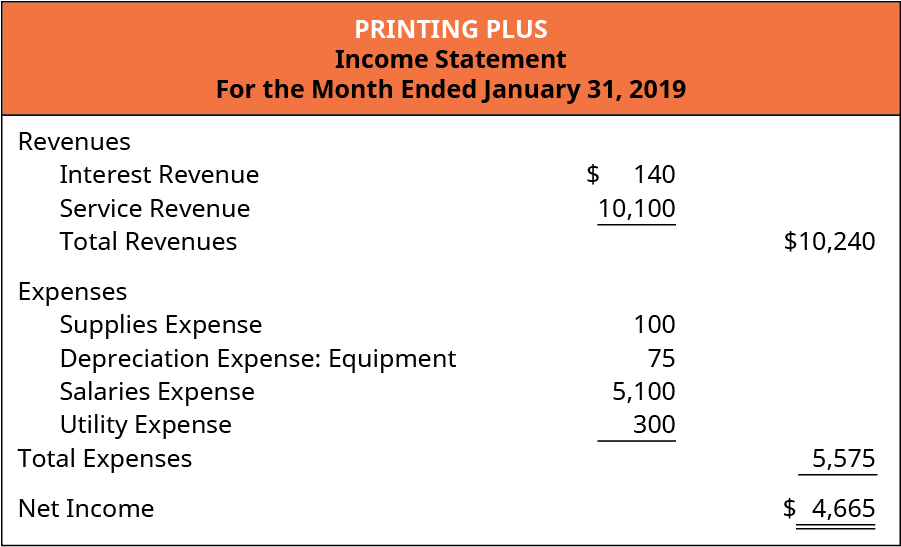

In such cases, the interest income is generated for these companies from ancillary activities. These companies record interest income in the ‘Other Revenue and Expense’ section of the income statement. The recording of interest revenue in the income statement depends on the nature of the business.

About the IFRS Foundation

IAS 18 states that ‘Revenue shall be measured at the fair value of the consideration received or receivable’ (12). In determining fair value it would be necessary to take into account any trade discounts or volume rebates granted by the seller. As long as the interest is not received, it is included in the interest receivable account, any changes in the balance marked by the receipt or issuance of interest revenue, will reflect in this account.

A note falling due on a Sunday or a holiday is due on the next business day. Interest Revenue improves a company’s profitability, provides a reliable source of cash inflow, and can help assess the efficiency of investments and inform future financial decisions. Delve into the realm of Business Studies with a comprehensive guide on Interest Revenue. This pivotal topic is discussed in detail, from uncovering the definition of interest revenue to understanding its role as an asset or liability.

For instance, a 75-day note executed on January 15th would be due on the 31st of March, unless it was a leap year, in which case it would be due on the 30th of March. If the bank loans out £10,000 at an interest rate of 5%, over the course of a year, the bank would earn £500 in interest revenue. Interest expense is the cost incurred by a company or individual irs issues 2021 mileage rates for business, medical, charity travel for borrowing money, typically from banks, creditors, or bondholders. Other annual disclosures about revenue are typically not required for interim financial reporting. Sales of a subsidiary or group of assets that constitutes a business or not-for-profit activity continue to be accounted for under the deconsolidation guidance (Topic 810).

In the simplest words, interest is the cost of using money we do not own. We pay interest when we borrow cash from a bank or take a loan to purchase a house or a car, etc. Businesses pay interest on business loans or commercial real estate loans from banks or other financial institutions.

- Note that in this calculation we expressed the time period as a fraction of a 360-day year because the interest rate is an annual rate and the note life was days.

- If you’re going to become an investor, there are a few things you should know — like these formulas.

- Sales of a subsidiary or group of assets that constitutes a business or not-for-profit activity continue to be accounted for under the deconsolidation guidance (Topic 810).

- Businesses pay interest on business loans or commercial real estate loans from banks or other financial institutions.

Learn to calculate it accurately using specific formulas and then apply this knowledge in practical, real-world business scenarios. The article also highlights common misinterpretations and mistakes to avoid while examining and managing interest revenue in business scenarios. These accounting terms can tell us how much interest a company earned and how much it expects to earn in the future. IFRS Accounting Standards are, in effect, a global accounting language—companies in more than 140 jurisdictions are required to use them when reporting on their financial health. The IASB is supported by technical staff and a range of advisory bodies.

This content is for general information purposes only, and should not be used as a substitute for consultation with professional advisors. Learn to calculate accrued interest on loans or credit cards, considering rates, daily balances, and precision methods. To calculate interest revenue for the 21 days up to the end of the year, you would follow the same steps as in the interest receivable example. Suppose a company issues a $10,000 note at 9% annual interest to your company that will mature in 60 days.

Interest income is revenue for the payee and an expense for the payer. Interest revenue increases the payee’s tax liability and reduces the payee’s tax liability because interest expense is tax deductible. Using this formula, we can calculate interest revenue in the previous example.

When the company receives the interest in the form of cash or bank in the next period, it can make journal entry by debiting cash or bank account and crediting the interest receivable and the interest income of the new period. Interest revenue is the income that a company earns from its investments in bonds, loans, or other interest-bearing assets. Frequency of a year is the amount of time for the note and can be either days or months.