6 Issues Should be aware the fresh USDA Loan

October 31, 2024

Supported by the us Agency from Farming, these finance promote the individuals living in faster and you will rural communities the new possible opportunity to individual a home at the sensible cost. In reality, USDA mortgage loans offer you so much more options whenever you are interested in one thing apart from a conventional mortgage, FHA mortgage, otherwise a great Va financing. Here are 6 things ought to know USDA observe when it is something you could be in search of.

step 1. USDA loans are not just to have producers even though they was entitled “rural” loans

USDA do need that your household get into an outlying city, however, for example certain areas that will be surprisingly residential district. You’re not simply for country properties or farming organizations. You simply cannot use the financing to order a beneficial doing work ranch, meaning a ranch useful industrial intentions. To find out if a house you find attractive is eligible, you can check out this new USDA web site.

You could money 100% of cost, which means that no need to own a down payment. USDA along with lets gift funds from relatives and buddies should you want to build a down-payment. There are even advance payment assistant programs to support the advance payment.

step 3. You are required to get home loan insurance policies with the USDA fund

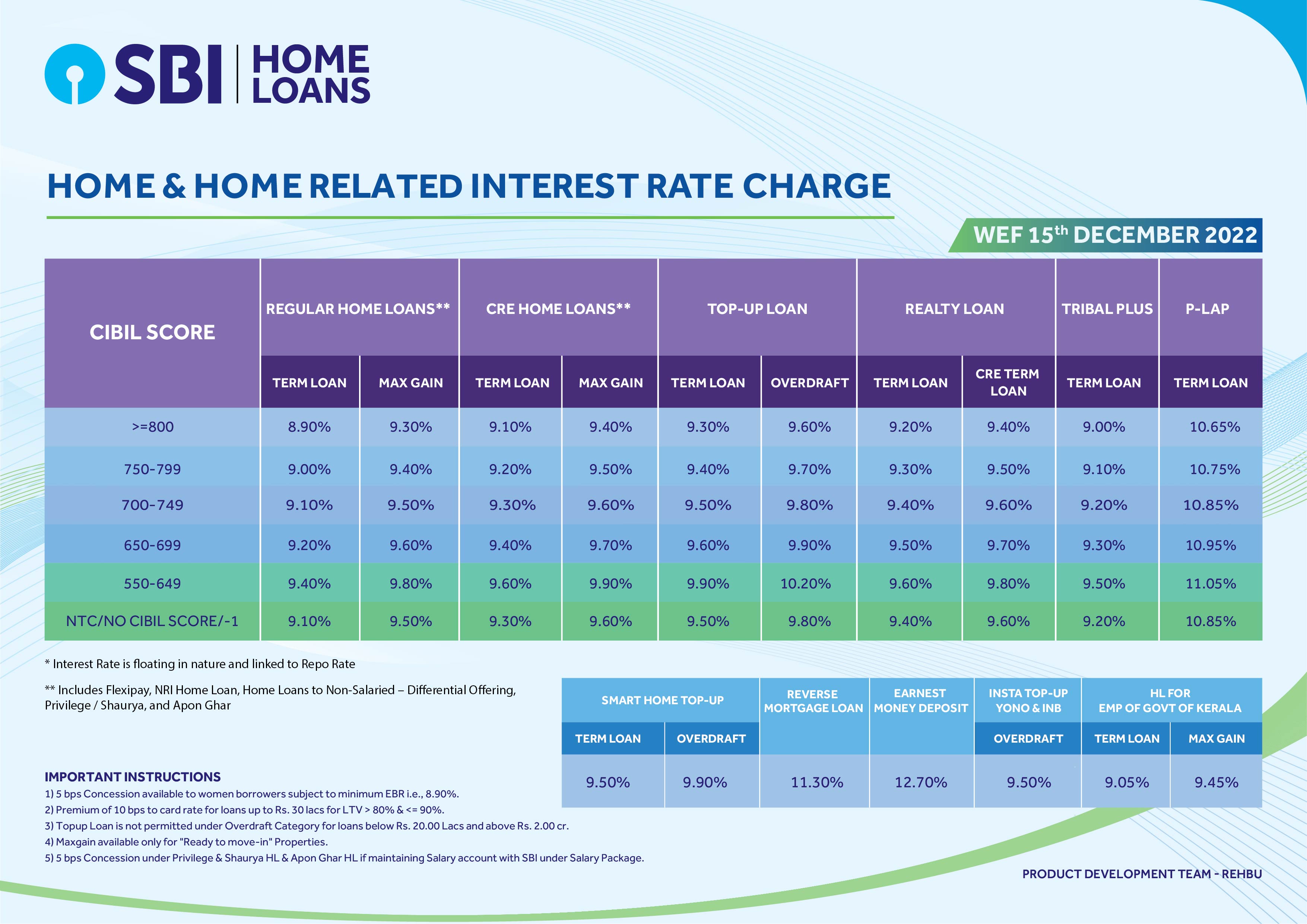

As you may fund 100% of your own loan, USDA funds additionally require home loan insurance coverage, hence already includes a two.75% upfront payment (USDA calls that it a vow commission) and you may an effective .50% annual make certain commission of dominant amount borrowed. You can roll the two.75% to your amount borrowed.

4. You have got more assets solutions having USDA fund

As previously mentioned above, you aren’t simply for farms which means this provides you with plenty of choices for your family. Check out household products you can consider having a beneficial USDA:

This indicates you to facilities aren’t the only version of home that you could purchase that have a great USDA although you usually do not fool around with the USDA mortgage to have money functions otherwise a holiday home.

5. USDA loans enjoys earnings restrictions.

USDA money are all about affordability so they established earnings constraints due to their loans. These limitations are based on the newest Agency from Property and you may Urban Innovation (HUD) Area Average Money (AMI) constraints. Currently, USDA was allowing 115% of one’s AMI founded from the HUD.

six. USDA refinances can also be found

USDA plus does refinancing which includes other programs, such as from Sleek-Let System because of its several benefits, although Low-Sleek and you will Sleek appear too. In lieu of with various financing, you simply cannot make use of the USDA accomplish a money-away refinance nevertheless the apps have its professionals and you’re capable skip a payment.

You can include otherwise eliminate consumers, for example, for individuals who had married or are becoming a separation, you could add someone to the loan otherwise remove them. That you do not necessarily need a drop in your fee for taking advantageous asset of these types of software. Instance, for people who curently have a great price and you can monthly payment but have to clean out a debtor in the loan, the new Non-Smooth and you will Sleek are great solutions. Should your assessment worthy of actually sufficient to defense both spend-out of on your own home loan, closing costs, and you can make certain payment you might have to be willing to spend people costs away-of-pocket with a non-Smooth and Sleek https://paydayloanalabama.com/opp/ program. In the place of the new Sleek-Help Program, you must have good payment record during the last six months, in which later costs dont go beyond 1 month. That have a streamlined-Help it is stretched.

An appraisal is not needed toward Streamlined-Help program, so that your loan amount is not limited by the fresh market value of the home, for this reason, you could roll your closing costs into your USDA financing and not pay them out of pocket. There are not any debt-to-money (DTI) criteria no matter if earnings restrictions would use. For instance, the complete house yearly money can’t meet or exceed this new moderate level having the room you are wanting to invest in a house. However you won’t need to examine your income against your financial situation, how you did when you entitled to your USDA loan. While the you’ll need to curently have an excellent USDA loan so you can be considered for this re-finance system, there was smaller paperwork using this type of mortgage system hence saves your valuable time when qualifying. You’ll want good payment history for the past 12 months. As stated in past times, late costs are those you to meet or exceed 29-days and might end up being reported. You’re not capable beat a debtor on mortgage however, can add on a debtor, such as, if you decide to currently have an effective USDA mortgage right after which got hitched and would like to include your own spouse in order to the mortgage, after that you can do it.