What forms of properties meet the requirements to possess USDA financial?

October 21, 2024

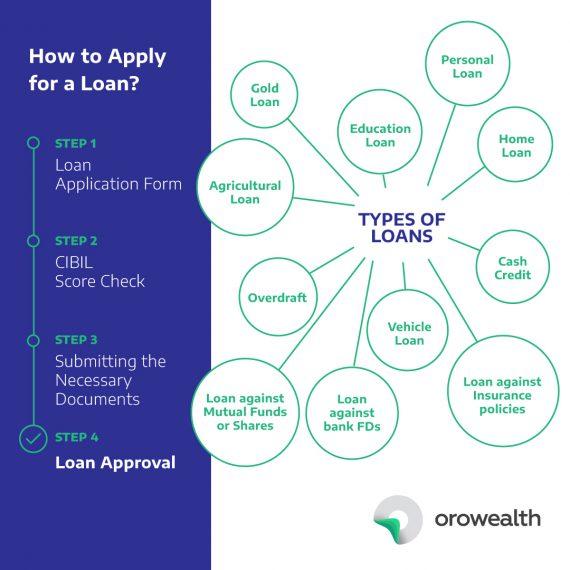

Step 1: Determine Qualification

In advance the applying procedure, determine if both you and the property you’re interested in meet the requirements to own an excellent USDA loan. Use the USDA’s on line equipment to evaluate possessions and income qualification.

Step 2: Get a hold of a beneficial USDA-Accepted Lender

Never assume all lenders and finance companies give USDA loans, so it is crucial that you find an effective USDA-acknowledged mortgage lender which is experienced in the applying. Coastline 2 Shore is proud so you’re able to suffice Ala homebuyers 1 week a week, only complete new Brief Request Means to get going.

Step three: Get Pre-Recognized

Getting pre-recognized to have good USDA mortgage provides you with an obvious tip from simply how much you really can afford and make your a very glamorous client. Locate pre-approved, you’ll want to provide us with paperwork for example evidence of money (w2’s, pay stubs, taxation statements) two-many years of employment records, two-several years of local rental history, and credit advice.

Step 4: Look for a home

Once you may be pre-recognized, you can start your home browse. Focus on a realtor who’s regularly USDA financing and certainly will support you in finding qualified characteristics inside Alabama.

Step 5: Fill out The loan App

Just after finding the finest assets, you’ll need to finish the complete loan application. This will cover taking even more current files and you can pointers because the questioned by the lender.

Step six: Household Appraisal and Review

The financial institution tend to buy an assessment to find the property value the home. On top of that, a property examination is preferred to identify any potential difficulties with the property. The new assessment means the property matches USDA direction which can be worth the price.

Step eight: Underwriting and Acceptance

As assessment and you can assessment try over, the application goes by way of underwriting. In this phase, the financial institution usually feedback all your valuable papers and you can make sure your own qualification. When the that which you checks out, you’re going to get last loan acceptance.

Action 8: Closing

Immediately following acquiring approval, possible move on to the new closing phase. Through the closing, possible signal the required data, shell out any closing costs, and you will perform the borrowed funds. Due to the fact documents is done, you’ll receive the keys to your new domestic!

USDA Mortgage Frequently asked questions (FAQs)

USDA loans can be used to pick all types of properties, plus solitary-relatives land, condominiums, and you will were created home. The home need to be situated in an eligible outlying town and act as the majority of your house.

Should i have fun with a USDA loan to help you refinance a preexisting financial?

Yes, the USDA also provides refinancing options, plus streamline and you can non-streamline refinance software, to aid home owners down their attention rates and you can monthly obligations. You must now have a USDA mortgage in order to refinance that have USDA.

Simply how much may be the settlement costs which have USDA money?

Settlement costs and you will prepaid escrows to possess taxes and insurance are 3%-5% of the price. USDA lets the house seller to cover the brand new customer’s closing will set you back. Customers also can move in their closing costs to their loan, and if the newest residence’s appraised worthy of is sufficient to support it.

What are the fees associated with USDA?

Every regulators backed loans need a one-time initial guarantee fee and FHA and you will USDA fund also provide a monthly (PMI) fees. New initial commission is usually step one% of the loan amount, while the annual payment (month-to-month mortgage insurance coverage) try https://availableloan.net/installment-loans-tx/riverside 0.35% of financing harmony. This new step one% at the start percentage should be folded to your loan amount.

The length of time does new USDA loan recognition processes simply take?

New closing process in Alabama normally takes thirty days, based factors like the lender’s mortgage regularity, the brand new difficulty of your own app, as well as the go out needed for the newest assessment and evaluation.