The whole process of To purchase a great HUD Family

December 2, 2024

FHA funds generally wanted a credit score no lower than five hundred but know that you’ll be able to deal with a top down payment with score regarding five hundred to help you 579 range.

Consumers with the help of our all the way down score have a tendency to face a 10 % down commission compared to step 3.5 % downpayment to have customers that have a credit history regarding 580 or higher.

Are convinced that you’re prepared to understand how to purchase a beneficial HUD house? The entire procedure is fairly easy, nonetheless it will help know what to anticipate ahead of time. Regarding the coming parts, we’ll take you step-by-step through what to anticipate when you’re wanting to purchase your individual HUD family.

Where can i come across good HUD house?

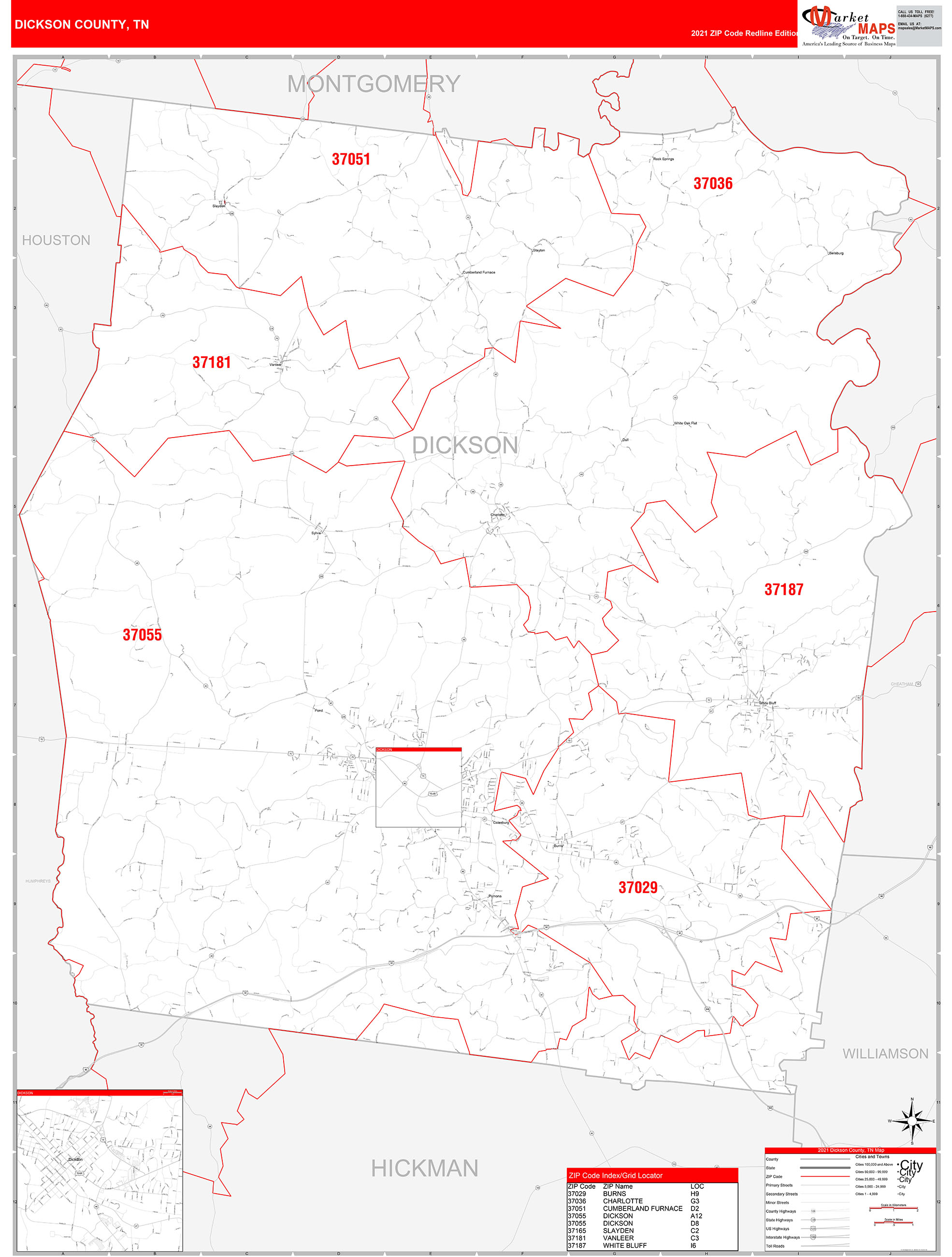

Most of the eligible functions detailed offered are found into government entities loan places Antonito webpages, HUDHomestore. This page makes you look for features close by from the county, city, condition, as well as zip code. The brand new HUD Homestore try a list website to help qualified consumers which have choosing the property that will works very well for their family unit members.

You don’t have to has another log on or background to view the attributes available from the Homestore. Individuals can certainly view the offered listings, as can home loans, government teams, and you will real estate agents which might possibly be wanting to help its readers.

There are more information on the brand new HUD home buying techniques and you can regarding the homeownership overall through this web page. There is no risk for only pressing around, so be sure to do a bit of browse on which you’ll be available on your own neighborhood before you can agree to buying a great HUD household.

How do i get to purchase HUD family?

The application form techniques for choosing a good HUD home is a tiny diverse from it is for lots more traditional and straightforward domestic orders. The initial thing you need to do are speak to your lender on what particular fund you could potentially qualify for.

That have a beneficial pre-approval at your fingertips can supply you with a heightened degree of trust and you will confidence upfront watching homes which have a bona-fide house representative.

Understand that a few of the characteristics into HUD Homestore are merely open to holder-occupants (people that own and reside in our home because their primary residence) during the a-two-times private checklist several months.

Next several months tickets, properties will feel offered to buyers, regulators businesses, or any other people just who would-be curious.

Whether you are an investor or a holder-occupant, you will need a beneficial HUD-acknowledged broker who’ll complete a bid to the wanted possessions for you. Which professional is needed if you like to invest in a HUD house since the people are not permitted to complete a bid as opposed to the assistance.

People try free to fill out a bid having any kind of amount your choose, be it higher otherwise less than the present day selling price.

Putting in a bid on an effective HUD house doesn’t mean that you’re going to automatically winnings the house. HUD reserves the right to accept people bring they prefer or in order to refute most of the also provides during the certain time frame.

What are the financial support options?

As a whole, you can purchase a great HUD house with one being qualified home loan. Of many people may want to imagine old-fashioned funding that features an excellent twenty percent down payment with no individual mortgage insurance and you can relatively low interest. not, there are more available options just in case you cannot scrape together sufficient savings to possess such as for instance a generous deposit.

FHA Capital

The FHA investment system the most popular possibilities for these in search of buying a good HUD household. So it financial support program also provides financing that’s partially backed by government entities, allowing lenders getting a bit more safeguards when it comes to help you financing to help you riskier people.