But it is one you have got to pay near to your typical month-to-month home loan costs

November 24, 2024

Are you aware that an incredible number of Americans are eligible to own a great mortgage with no advance payment? Which several of homebuyers can get you to having a small downpayment from just 3.0% otherwise step 3.5%? No? Don’t be embarrassed for individuals who don’t understand; this is a complicated matter. Just be prepared to learn more — and apply.

You might be skeptical in the mortgage loans having a zero or lower advance payment. Won’t people come from suspicious, predatory loan providers that out over exploit you? No! Zero-off mortgage programs is backed by government entities, and more than low down percentage fund is actually supported by the FHA, Federal national mortgage association and you will Freddie Mac.

Those individuals federal agencies and you can groups merely ensure a part of your own financing, and you may remain borrowing away from a personal organization. But the most away from mortgage brokers promote certain or all of the of those lower-or-zero-off loans — along with famous labels and you will very reputable of those, to help you choose one you might be comfortable with.

Was 3% down excess?

While you are borrowing $100,000, $two hundred,000 or at least more, also an effective step three% down payment can seem an impossible dream. However,, for most, it need not feel. All over the country, tens of thousands of programs help to let homeowners through its downpayment demands — and regularly making use of their settlement costs. These types of offer “advance payment direction applications,” aka DPA programs.

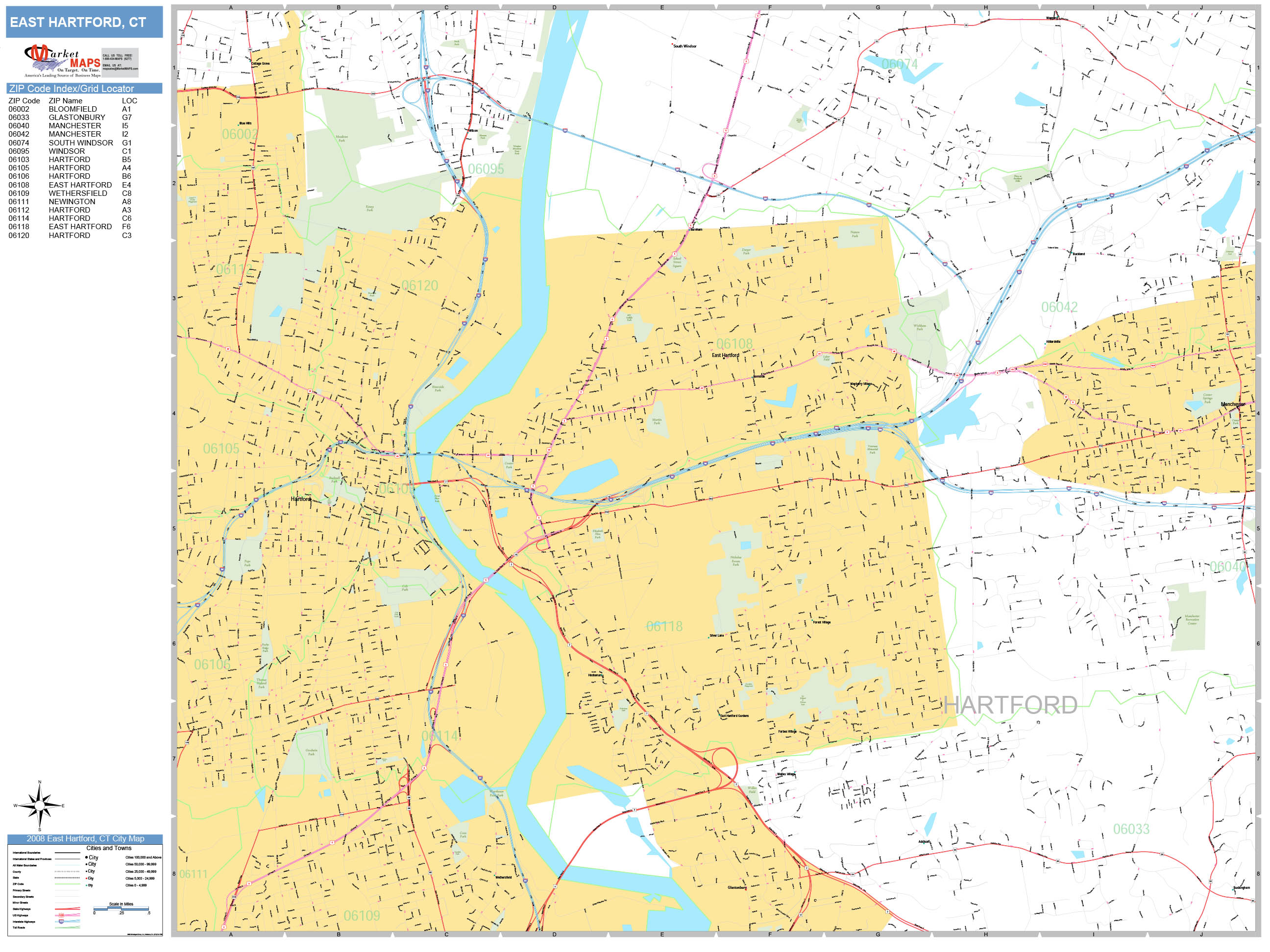

How much cash you get and also the function it takes try a zip-code lottery. If you are happy, you may get lots of their deposit and you will closing costs included in an offer (effectively a present). Somewhere else, you’re provided an effective 0% otherwise lowest-notice mortgage which is forgiven more than decade, providing you always reside in the home.

If you find yourself “unlucky” (and that’s a family member name right here), you can get a 0% otherwise reasonable-attract mortgage to cover your deposit. Even then, the DPA system needs care to ensure you could potentially easily pay for your entire payments.

Specific lowest with no-downpayment home loan guidelines

There are also popular apps that enable you to use the downpayment. Federal national mortgage association identifies those people deposit money once the “People Seconds” if you find yourself Freddie Mac dubs them “Sensible Mere seconds.”

However you need to to see rules. Such as, you ought to constantly plan to use the house since your dominant home. And you can Fannie states:

. fund need to be provided with a national service, an effective town, condition, state or regional houses finance agency, nonprofit team, an area Government Mortgage Lender below among the sensible houses applications, an indigenous Western group otherwise its sovereign instrumentality, or an employer.

Mislead? You are not by yourself

You truly really should not be embarrassed if the all of this try reports to you. You are in good team. Within the , Fannie mae published a survey into identity, Consumers Continue to Overestimate Home loan Conditions.

They discovered persisted higher levels of frustration one of wannabe residents more exactly what mortgage lenders anticipate from them. This post is a make an effort to make it easier to personal what Fannie phone calls one “knowledge-gap.” Even in the event “chasm” is a much better phrase. While the study located people consider it necessary:

- A higher credit score than simply they actually do (typically, 650 as opposed to the 580 they often in reality need)

- A top deposit than just is actually requisite (normally 10%, rather than the 0%, step three.0% or step three.5% are not offered)

- Less present debt than simply loan providers in reality expect (they feel lenders need 40% otherwise a reduced amount of all your family members income to return on current expense, together with your the latest mortgage and you will citizen expenses. Actually, it could be to fifty%)