Gen Z Desires this new Western Dream: These types of 5 Economic Tips May help Create an actuality

November 18, 2024

Another questionnaire of Freddie Mac computer means that Age group Z – Us americans between the age of fourteen and you will 23 – are seriously interested in getting property owners. Also so much more upbeat about this than its millennial cohorts have been in the how old they are.

Actually, the majority trust they will very own property from the age of 31 – 3 years more youthful versus most recent median basic-go out homebuyer decades.

- 86% out-of Gen Z desires own a house

- 93% look for homeownership since the something you should getting proud of

- 88% state it gives independence and you can control

- 86% find it as the a sign of achievement

In the event the one thing would be to stand-in the way in which of its homeownership wants, Gen Zers mainly agree it’d become currency. With regards to the questionnaire, Gen Z observes the greatest barriers since home values, off money, and work imbalance.

Building the origin having Homeownership

Luckily for us, Gen Zers’ futures commonly https://clickcashadvance.com/personal-loans-ok/ invest brick – and there’s enough time to get those individuals cash down prior to season 29 arrives.

Are you presently among the scores of Gen Zers with homeownership with the head? Here’s how to create oneself up for success:

Talk to a monetary elite.

This is certainly gonna voice a small premature, especially if you’re on younger end from Gen Z correct now, but it’s truly never ever too-soon in order to meet having a financial coach. In the event the moms and dads keeps their own mentor, it could be as simple as asking them to provide you with so you can a scheduled appointment together.

As to the reasons thus in the future? Borrowing plays an enormous role from the financial techniques, and also the greatest your credit score, the greater your chances try to be acknowledged for a mortgage and purchasing a house. Their background having borrowing (i.e., along their account/how long you’ve got all of them discover) makes up approximately 15% of one’s total credit score – and strengthening the borrowing takes time and effort. When you get an effective professional’s advice about smart an easy way to start building your own borrowing from the bank today – and also you follow up for another years or more – your might get in a great reputation before you go to be a homeowner.

Don’t use significantly more borrowing (and take for the even more debt) than you desire.

Just because you’ve got credit cards doesn’t mean you’ve got to use it. End up being wise regarding the if you utilize a charge card or loan, and only do it when essential.

- Watch the debt-to-earnings ratio. Your debt-to-earnings proportion ‘s the part of your earnings one would go to paying down all types of obligations. Once you sign up for home financing, their lender can look at the obligations-to-money ratio to decide just how much family it is possible to manage.

- Keep balances reduced. Pay your own costs week just after month, plus don’t assist one to balance creep on you.

- Remove the student loans.Student education loans helps it be harder to shop for a property. Remove merely what you need, and consider functioning thanks to college or university to cover lease, debts, and other costs.

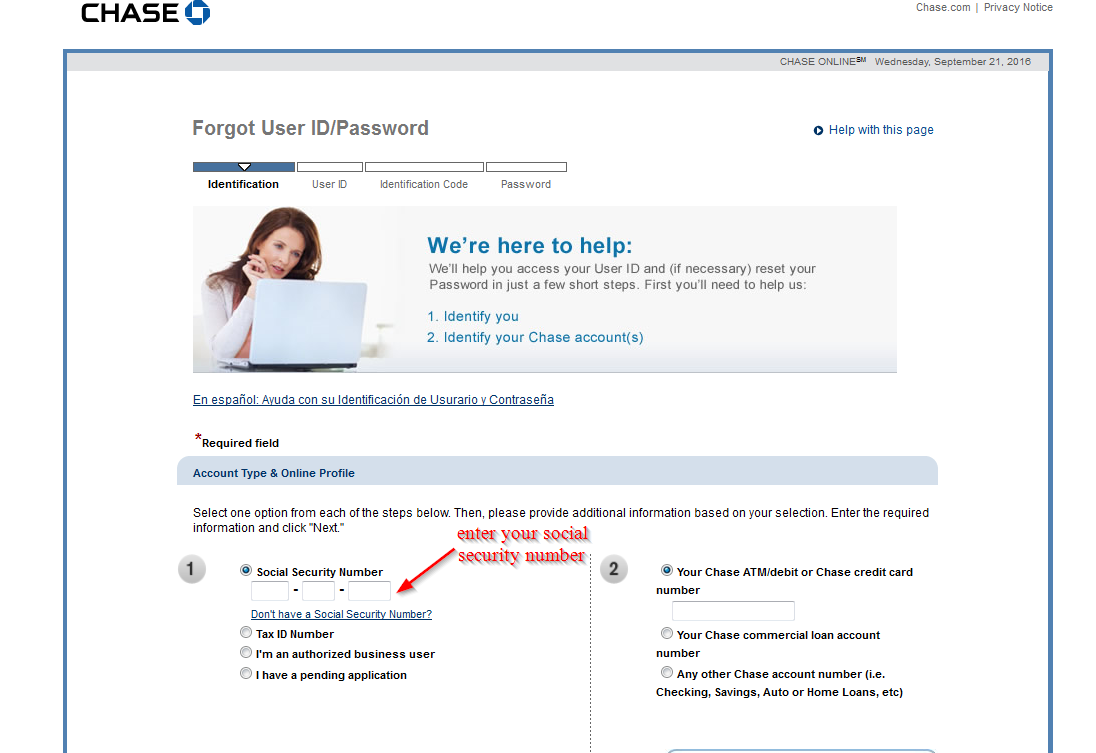

Pull your credit report a year.

You will be eligible to a totally free credit report immediately following a-year, thus benefit from it. After you pull they, you should

- Aware the credit agency of every errors the truth is. It assists your credit score.

- Watch for levels that you don’t know . It might indicate you are a target regarding id theft.

You have made you to free report out of most of the about three credit reporting agencies annually, so you might want to spread them aside. See AnnualCreditReport to get your earliest you to now.

Have fun with technical for the best.

You’ll find loads regarding tech that will help spend less, make your borrowing from the bank, plus without difficulty purchase a house. A lot of them try 100 % free, too.

When you’re having problems rescuing upwards to possess an advance payment, these tools can help you place your targets, control your currency, and possibly stow away a manageable sum of money over the years.

Strive to see the mortgage procedure.

In the long run, make sure to know about mortgage loans, together with just what qualifying requirements you’ll end up kept in order to just after you sign up for you to. If you like help, get in touch with a mortgage professional on Incorporate Lenders today. We will take you step-by-step through the method, together with credit score, advance payment, or other requirements you’ll want to meet one which just get a house.

Interested in how much cash house you can afford? We can assist truth be told there, as well. Merely text Meet the requirements to 22722 to find out if your pre-be eligible for a mortgage.

Advice within this [email, blog post, etc.] are normally taken for website links otherwise recommendations to 3rd-team information otherwise articles. Embrace Lenders will not promote or make sure the reliability off it third-group information. For many who follow these types of hyperlinks, you happen to be connecting to an authorized website maybe not manage by the Accept Mortgage brokers. We are really not guilty of the content of that website and you will the confidentiality & shelter policies can vary out of those individuals skilled because of the Incorporate Lenders.