The five Components of a FICO Get

October 31, 2024

When you make an application for payday loans Pine Apple a mortgage, their lender runs a credit file. An extremely important component of declaration can be your credit rating. One of the most commonly used fico scores throughout the mortgage industry is FICO.

In this article, we identify what FICO is actually, the way it was counted, the way it is utilized whenever giving you for a home loan, and you will activities to do to keep and you will replace your credit get.

What is actually FICO?

FICO try a credit score developed by this new Fair Isaac Organization (FICO). This new FICO team focuses primarily on what is also known as predictive analytics, for example it capture advice and you will analyze it to help you anticipate just what might happen subsequently.

Regarding your FICO score, the organization talks about your own previous and you can current credit use and assigns a get that forecasts just how most likely you are to spend your costs. Mortgage lenders make use of the FICO score, along with other info on your credit score, to evaluate exactly how risky it is so you’re able to financing you tens or thousands of bucks, as well as exactly what rate of interest you ought to spend.

Lenders use the FICO rating, with other information about your credit history, to assess borrowing chance and determine whether to increase credit and you will what rate of interest you will want to spend. Chad Whistler, Mortgage step 1 Mortgage Officer

Why is FICO Essential?

Credit ratings can be used much more than 90% of borrowing from the bank decisions built in this new U.S. That have a reduced FICO get is actually a package-breaker with several lenders. There are numerous form of credit ratings. FICO is among the most widely used get regarding financial community.

A lowered-understood reality on the Credit ratings would be the fact some individuals lack all of them whatsoever. To generate a credit score, a customers should have a certain amount of readily available information. To have a good FICO score, consumers need a minumum of one membership which was open to have six or higher days and at least you to membership that could have been claimed into credit reporting agencies in the last six months.

FICO Score Range

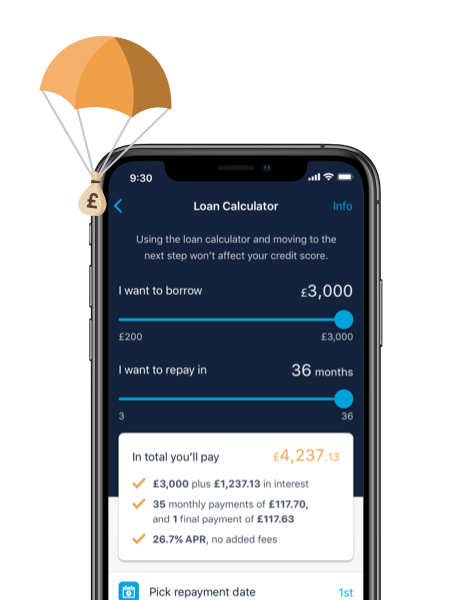

Credit ratings are priced between three hundred and 850. A higher number is ideal. It means you are reduced chance so you’re able to a lender.

Score regarding 670-739 assortment mean good credit rating and more than loan providers tend to look at this score favorable. Borrowers about 580-669 assortment could find it tough to receive capital at the glamorous rates. Lower than 580 and it is hard to find financing or you can be charged loan-shark costs.

A knowledgeable FICO rating a customer may have is 850. Less than 1% off customers provides the ultimate rating. Over a couple of-thirds out-of people have score that will be a great or most useful.

- Percentage Record. Percentage background refers to if or not you only pay the borrowing membership promptly. A card records shows whenever money was indeed submitted just in case any was in fact later. The brand new statement refers to later or shed money, together with any bankruptcies.

- Most recent Indebtedness. This is the amount of cash your currently are obligated to pay. Which have a number of obligations does not indicate you are going to has a reduced credit rating. FICO talks about this new ratio of money owed to the amount out of borrowing from the bank offered. Like, if you owe $50,000 however they are not close to interacting with your overall credit limit, your own rating is going to be more than a person who owes $ten,000 however, possess the personal lines of credit completely prolonged.

- Length of Credit rating. The latest prolonged you may have got borrowing, the better your get might possibly be. Credit ratings be the cause of just how long brand new oldest membership keeps already been unlock, age this new membership, and also the overall mediocre.