In the event the a lender allows an appraisal aside from a proper assessment, the borrowed funds isn’t precisely a zero-assessment HELOC

October 27, 2024

Solution Types of Appraisals to own HELOCs

However, the exact opposite actions is minimal and you may reduced to the an assessment having an effective HELOC. Banking companies and you will lenders will always be evaluate your own home’s really worth with a couple kind of valuation method, in the event an official assessment isn’t really called for. Such as, the lender could use a computer automatic valuation method (AVM) in lieu of a timeless assessment.

HELOC Drive By the Assessment

From inside the a drive-because of the assessment, the latest appraiser does not privately see brand new property’s interior but merely appears in the additional. The fresh new drive of the assessment getting HELOC and you can domestic security funds is cheaper than a complete URAR therefore costs faster given that better.

Desktop HELOC House Assessment

A pc HELOC domestic assessment is largely an internet appraisal during the and therefore no inside-person check is done. The latest desktop appraisal is fairly well-known to have consumers having a good credit score ratings as well as brief financing numbers between $20,000 so you can $100,000.

In this types of appraisal, the new appraiser uses public records, instance latest sales and you can listings off comparable functions regarding the urban area. They might also consider flooring plans and you will pictures of the property.

Hybrid Appraisal

A crossbreed appraisal involves a 3rd-class evaluation, that https://paydayloancolorado.net/cattle-creek/ licensed appraiser then spends to search for the property’s markets worthy of. This new appraiser in addition to performs research on line.

Automated Valuation Model

An automatic valuation design, or AVM, is software you to definitely instantly determines the fresh property’s well worth using in public areas readily available a residential property analysis.

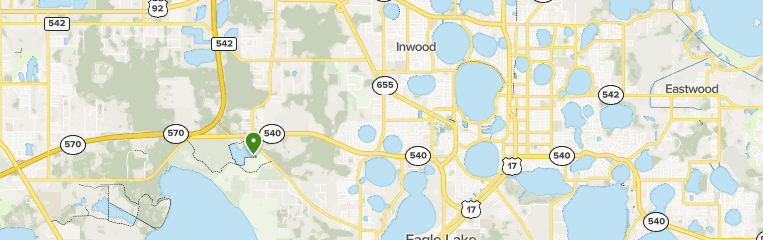

Such HELOC appraisal generally speaking considers previous sales regarding equivalent functions in addition to their details, for example town, reports, and you may venue. The fresh new AVM ‘s the drawer matter to a getting a good HELOC rather than assessment.

Knowing the HELOC Assessment Procedure

Should you want to quickly supply their residence’s collateral, a no-appraisal HELOC otherwise domestic security mortgage is actually an incredibly tempting choice. Individuals see household collateral funds while they often provide smaller financial support because they avoid the traditional assessment procedure, which is very day-drinking.

In the event that marketplace is very hot, appraisers score supported immediately after which which drives the cost of this new assessment up as well. By detatching the necessity of an expert valuation, lenders normally notably reduce the recognition schedule, letting you entry to the credit range faster. However, it is vital to keep in mind that often so it benefits may translate so you’re able to particularly large interest levels and you will origination fees. Shop and you may contrast the present HELOC interest rates.

In spite of the speed and convenience, no-assessment household security credit lines and you will loans carry built-in threats. Without an accurate comparison of your home’s market well worth, you might find yourself borrowing more than your property is worth, potentially causing negative equity in the event the casing cost decline. On top of that, finance companies get enforce faster better terms to reduce the possibility of not requiring a good HELOC appraisal. We advise you to inquire initial just before submission files whether or not or perhaps not the lending company now offers a zero assessment HELOC and you can precisely what the general standards try to have including another financing.

As to why Consider HELOC Appraisal?

An excellent HELOC home appraisal is not always a detrimental procedure, in the event they can cost you money. In case your bank need the full or some other particular appraisal, it may actually benefit you.

I think, it is best to has actually an appraisal if you’ve had the property for at least 2 years otherwise are now living in an enthusiastic city in which prices are increasing easily.

Such as, into the a house increase regarding 2020 and you will 2021, home owners watched their homes’ worthy of raise somewhat, and therefore translated towards a whole lot more guarantee.

However, all of that can simply be computed which have an assessment. By using an assessment, you could potentially dictate the genuine market price in your home, that’s more likely higher than the time you bought they if you’ve had they for some time.