Financial Income tax Positives Informed me: Save Ample Taxation on your own Mortgage

October 27, 2024

Taking a mortgage in Asia is pretty effortless nevertheless shall be an expensive fling. But not, there was a gold lining to it, that’s different income tax professionals one could score the season inside, as per the specifications of your own Tax Work, from 1961. That it Work contains certain parts around and that more home loan income tax pros was provisioned to possess home loan consumers so you’re able to get.

A home financing have one or two points: payment of your prominent share together with desire repayments. Thank goodness, these qualify for tax write-offs. Whenever you are dominant fees is actually deductible under Area 80C, deduction towards desire fee was welcome less than Section 24(b) of your own Taxation Operate, 1961. Continue reading to learn how to acquire the eye into the housing financing deduction to have ay 2023-24.

Income tax Gurus to your Lenders

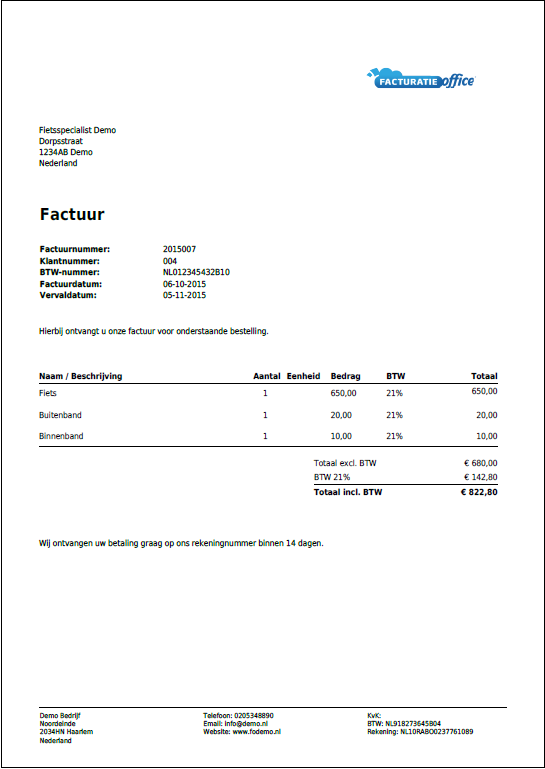

The next dining table reveals the fresh new yearly taxation pros in different parts of the money Taxation Act, regarding 1961, reflecting your house financing appeal taxation deduction and you will housing loan attract difference.

So it loan should be approved (birth 01.cuatro.2016 and you may stop 30.3.2017). The borrowed funds count is less than otherwise equal to ?thirty five lakh and also the property value assets does not exceed Rs. ?fifty lakh.

Part 80C: Income tax Professionals for the Payment of the home Loan Dominant Amount

A mortgage debtor was allowed to claim taxation advantages upwards so you’re able to ?step one,fifty,000 to your dominating commission away from his/their taxable money, every year. So it benefit would be stated for both rental and you may worry about-occupied services.

- To allege benefit not as much as that it area, the house by which the mortgage has been lent is going to be fully built.

- Most income tax benefit of ?1,50,000 can claimed lower than that it section to possess stamp duty and you can membership fees; yet not, it could be stated only when, we.e., at the time of these types of costs incurred.

- A good deduction claim cannot be produced if the same house is marketed within this 5 years from arms.

- In this situation, people stated deduction might be reversed in the year of selling. Additionally, it sum will be as part of the person’s income towards the season, where property is offered.

Not as much as Point 24(b), an effective taxpayer is also allege an effective deduction on attract paid off into the house financing. In this situation,

- One could claim good deduction on attention paid off towards the household mortgage for a personal-occupied home. The maximum tax deduction acceptance is up to doing ?2,00,000 throughout the gross yearly income.

- But if a guy possesses two belongings, upcoming in that case, the new combined income tax allege deduction for mortgage brokers dont exceed ?dos,00,000 during loans Dayville CT the a monetary year.

- If the house has been hired aside, then there’s zero restriction about much one could claim to the notice reduced. This consists of the whole amount of appeal reduced into the family loan into the get, construction/reconstruction, and revival otherwise fix.

- In the eventuality of losings, one could claim an effective deduction of just ?2,00,000 inside the an economic 12 months, as the remaining allege can be carried send for a tenure out of 7 many years.

Not as much as Section 24(b), an individual may and additionally allege good deduction to the rate of interest if for example the assets bought try lower than framework, just like the construction is done. It part of the Act allows says to your one another pre-structure and blog post-build months focus.

Area 80EE: Extra Write-offs to your Attract

- Which deduction will be reported only if the price of the fresh new domestic received doesn’t exceed ?50 lakh and also the loan amount is perfectly up to ?thirty-five lacs.