FHA and USDA loans you want specific documents to possess acceptance, such as an ID, pay stubs, and taxation statements

October 24, 2024

While faced with the decision from whether to match a great USDA loan or an enthusiastic FHA loan, it does commonly feel just like a tough choices. Although some of one’s conditions could possibly get overlap, you can find trick distinctions you to definitely place all of them other than both.

To understand the distinctions best, take a look at the dining table provided below. It features the quintessential circumstances you must know when you compare USDA compared to. FHA money.

Why don’t we discuss this new specifics of multiple circumstances and you may understand points when you to loan kind of might be alot more advantageous than the most other.

Financial Approval Procedure

Thought providing financial pre-acceptance for the FHA otherwise USDA mortgage so you can speed up the fresh techniques. Despite preapproval, it may take 29 to forty five weeks to get rid of the borrowed funds and you will personal toward home.

Brand new USDA mortgage techniques might possibly be longer than a keen FHA mortgage due to the fact USDA finance proceed through twice underwriting-basic from the financial and from the USDA.

Our home have to go through an assessment by the one another USDA and FHA to make sure you happen to be using a reasonable speed, but USDA financing skip the house review step .

FHA loans come with their unique band of requirements that’ll extend new schedule. Your own bank will need an assessment and you will evaluation from an enthusiastic FHA-recognized appraiser ahead of closure.

When you close, you’re anticipated to transfer to the home contained in this two months and alive around since your fundamental home for around annually. Failing woefully to satisfy these types of criteria may lead to legal issues.

USDA and FHA financing should help individuals exactly who can get find it difficult to meet with the down payment needed for typical financing. USDA funds do not call for a down-payment. But not, if you opt to build a down-payment , you will most certainly reduce your month-to-month mortgage repayments therefore the rate of interest towards loan.

To own an enthusiastic FHA mortgage, which have a credit rating ranging from five hundred in order to 579, a downpayment with a minimum of 10% of the residence’s purchase price is required. In case the credit rating try 580 or maybe more, FHA mandates the very least step three.5% downpayment. Similar to USDA fund, a more impressive down payment can result in down interest levels and you will monthly home loan repayments .

Mortgage Insurance policies

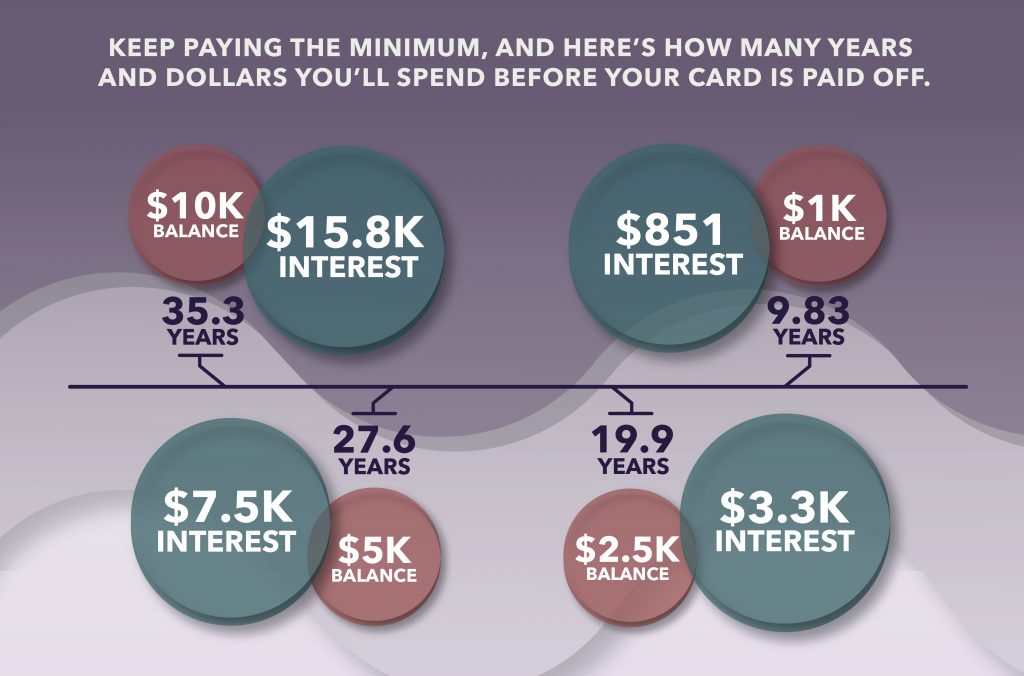

Mortgage insurance is incorporated when you get often an FHA or an excellent USDA loan. However, the quantity you pay to own home loan insurance rates may vary based on the application form you decide on.

To own FHA funds, the mortgage insurance costs are large as compared to USDA loans, especially if you make an inferior down-payment. For individuals who deposit minimal 3.5%, your own monthly home loan advanced could well be 0.85% of the loan amount. So it superior need to be paid down from the entire home loan term, as well as the upfront fee of 1.75%.

Of USDA money, the desired advanced, known as the funding commission, do not exceed 0.5% of your own kept balance and 3.75% initial. You happen to be expected to pay the month-to-month advanced on the whole name of USDA mortgage.

Earnings Standards

If you are considering an enthusiastic FHA financing, your earnings isn’t really a deciding basis. There aren’t any specific earnings constraints, however you need have indicated a reliable income that safeguards your own financing. Typically, you’ll have to show taxation statements, spend stubs, and you will work confirmation in the application processes.

For the USDA financing system, discover income restrictions. Your income shouldn’t go beyond 115% of mediocre income on your region. Since the lifestyle can cost you and you may salaries disagree across the says, specific parts create large income thresholds. You might ensure their qualification according to your local area through the cash loans Thomaston no credit check USDA’s web site.