Financial insurance versus name otherwise permanent life insurance

October 23, 2024

What exactly are recommended financial insurance policies points

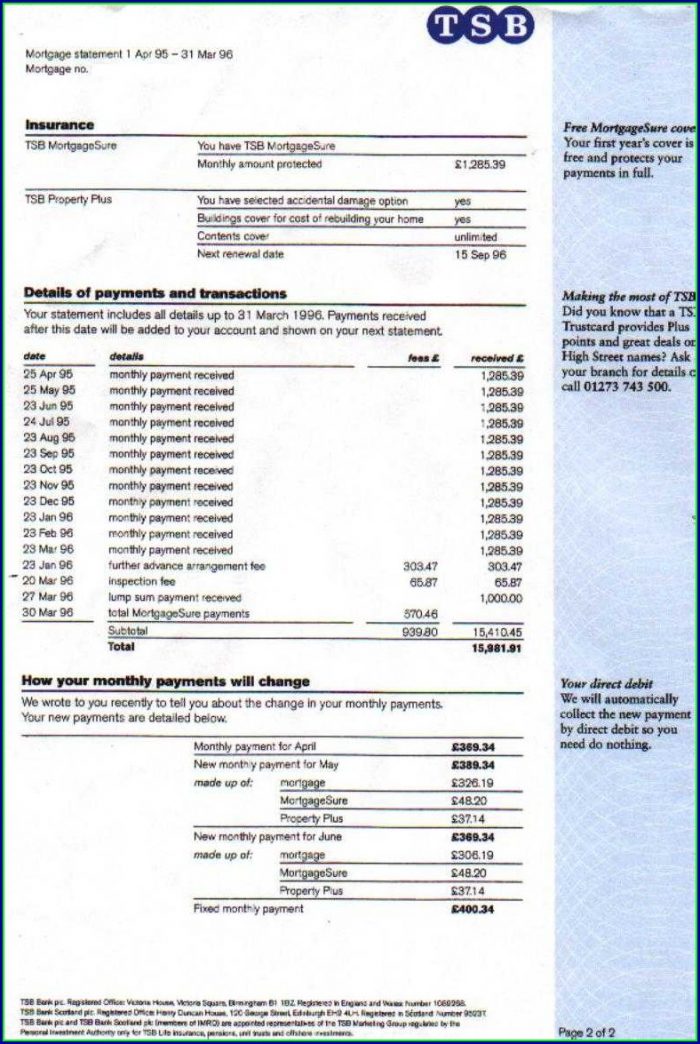

Optional home loan insurance policies items are life, disease and you may disability insurance products that might help generate mortgage payments, or will help repay the others due on your own mortgage, for many who:

- remove your work

- end up being injured or disabled

- feel vitally unwell

- pass away

Optional home loan insurance is a type of borrowing from the bank and you can financing insurance that you’re always considering when taking aside otherwise renew a beneficial financial. You don’t need to get recommended mortgage insurance coverage getting acknowledged to have home financing.

Make sure that the insurance meets your needs regarding coverage. In case your lender was good federally regulated bank, they want to provide market your products which might be appropriate for your, centered on your position and you may financial requires. Nonetheless they have to let you know if the they’ve assessed you to something or solution actually befitting your. Take time to establish the money you owe to be certain your get the right product. Please inquire and make certain you know this new insurance equipment you have or wanted.

Discover crucial limits into the visibility that elective financial insurance rates issues provide. Discover the rules very carefully and have questions if you have everything you hardly understand before purchasing these products.

This type of optional goods are distinct from real estate loan insurance rates you have to get should your downpayment on your domestic is below 20%.

Home loan insurance

Home loan insurance is actually an elective product that will get spend the money for balance on your financial to the bank on their demise. This product try elective. It could be of good use if you have dependents otherwise a partner who you’ll like to remain in your home just after their passing, but just who may not be in a position to keep putting some exact same home loan repayments as the ahead of.

Prior to purchasing mortgage life insurance, find out if you have insurance that fits your position through your company or other policy.

Understand that your property will likely be sold to spend straight back the borrowed funds, thus home loan life insurance coverage might not be essential you.

Simply how much home loan life insurance coverage costs

You pay a fee entitled a made, based on the amount of your own home loan along with your ages. Superior are added to your own regular mortgage payments.

As you lower the home loan, the brand new advanced essentially are still a similar https://cashadvanceamerica.net/loans/loans-for-truck-drivers/, no matter if you’ll are obligated to pay shorter on your mortgage throughout the years.

Where you’ll get mortgage life insurance

You can aquire financial term life insurance via your home loan company, otherwise using a unique insurance carrier or financial institution. Look around to make sure you will get an educated insurance to help you be right for you.

The lender cannot force you to get an item while the an ailment getting another type of service or product from their store. It is called coercive tied selling.

Label or long lasting term life insurance might provide better value than simply mortgage life insurance coverage. Having title otherwise long lasting insurance, the fresh death work with, otherwise amount payable toward beneficiaries, won’t drop-off across the title of one’s policy. Up on your death, their beneficiaries are able to use the insurance coverage currency to fund the latest mortgage.

Mortgage disability and you may crucial problems insurance

Financial handicap and important issues insurance may make mortgage payments so you’re able to the lender if you can’t work due to a severe burns or infection.

- crucial illness insurance rates

- disability insurance

- occupations losings insurance policies

- life insurance

Very insurance policies keeps an abundance of requirements connected with all of them, together with a certain variety of ailments otherwise wounds that will be protected otherwise omitted. Pre-existing diseases usually are perhaps not protected. These fine print out of insurance policies is placed in the insurance certification. Query observe the insurance certificate before applying, so you understand what the insurance coverage talks about.

Before you buy home loan handicap or vital infection insurance coverage, verify that you currently have insurance that meets your circumstances during your company or any other policy.

How much cash financial handicap and you will crucial issues mortgage insurance premiums

Might shell out a charge entitled a paid according to research by the amount of your own home loan and your age. You have to pay which advanced month-to-month for the identity of your own home loan.

You should buy mortgage disability and you can important disease insurance rates through your home loan company, otherwise because of an alternative insurer or standard bank. Check around to make certain you’re getting an educated insurance policies in order to work for you.

The financial are unable to lead you to pick an item as the a disorder to get a different sort of product or service from their store. This is certainly named coercive fastened offering.