Many loan providers play with a benchmark regarding 80% LVR getting home loan applications

October 18, 2024

Once a loan provider features analyzed your income and costs, they’re going to know what you can afford based on your current issues. Although not, your position can alter during the a home loan, thereby can also be the pace. For this reason, the Australian Prudential Controls Power (APRA) enforces good serviceability buffer out of 3%.

So it shield form loan providers need certainly to evaluate whether or not you really can afford a good home loan in the event the interest levels raise because of the step three%. Including, for people who sign up for that loan with an effective 6% rate of interest, lenders have to test that you could nevertheless pay the mortgage with good nine% interest.

Put and you will mortgage-to-worth ratio

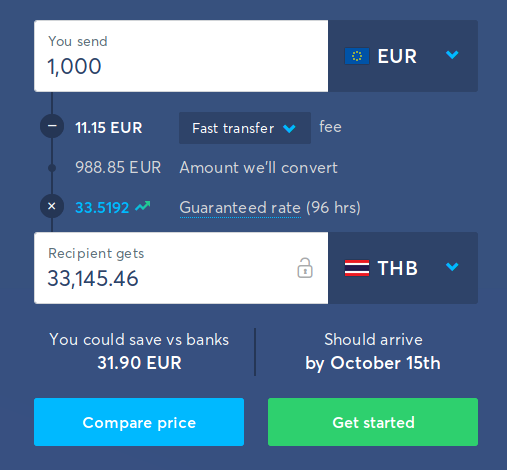

Of several lenders explore that loan-to-worthy of payday loans Lamont ratio (LVR) to evaluate exposure and discover just how much you really can afford so you’re able to borrow whenever trying to get home financing. LVR actions what size the mortgage are in accordance with this new deposit, and you will a premier LVR stands for a top exposure to the financial.

Essentially, need 20% of property’s value because the in initial deposit. So, if you would like buy a property value $five hundred,000, you might want $100,000 (20% of the really worth).

Application criteria

Typically, in initial deposit are typically in the type of money in to your bank account. Instead, you can make use of equity inside an existing possessions just like the a deposit.

With a massive deposit will help your chances of qualifying to possess home financing, whilst form faster risk on the bank. At the same time, the bigger your own deposit, the latest reduced you will pay inside desire across the lifetime of your loan.

If you don’t have good 20% put, you could however safer a mortgage but can need to pay lenders’ mortgage insurance coverage (LMI). Your own financial removes LMI to help you ensure by themselves for folks who standard for the loan costs as well as the possessions has to sell for reduced versus a fantastic number for the mortgage.

Specific loan providers render mortgages that have in initial deposit as small as 5%. Although not, discover constantly plenty of terms and conditions attached.

Age and financing identity

Lenders also consider your ages plus the financial duration when determining a credit card applicatoin. As far as mortgage qualification conditions: a home loan would be ranging from 20 and 30 years enough time; the minimum ages requirements are 18 years.

Older candidates may rating refuted if the a lender can be involved about their earning function throughout the label away from a home loan. The high quality retirement in australia is 65-67, and you will lenders is actually wary about mortgage terminology stretching beyond retirement. Therefore, adult decades individuals need reveal that they can make mortgage repayments when they are amiss.

Don’t think it is possible to be considered?

To own individuals closer to that it endurance, you can however see a mortgage approval. not, you may have to give significantly more evidence of economic form than a more youthful debtor. That it proof can sometimes include:

- A much bigger deposit

- Shorter mortgage that have higher payments

- A great deal more coupons

- Highest income on left many years you wish to performs

- Safeguards for the financing in the way of a residential property

- Shares/securities.

Property assessment

After you apply for a mortgage, your bank will even require factual statements about the property. That it assessment was simple process of the lending company to check one exposure to discover when your financing your make an application for matches brand new property’s worthy of.

Simple financing criteria

After you submit an application for home financing, the house will act as cover on loan. For those who default on your own payments, the lending company are available the house or property to settle their leftover costs. A loan provider assesses the property to ensure it won’t clean out really worth, causing a monetary losses if they need to sell.