Funding Their Mobile Family: A guide to Mobile Lenders

October 9, 2024

- Type of cellular home loans

- Being qualified to possess a mobile financial

- Where to find mobile lenders

Associate website links on factors in this article come from couples one to make up united states (come across our very own advertiser disclosure with our selection of people for lots more details). Although not, the views was our personal. Observe how i speed mortgage loans to write unbiased product reviews.

- Mobile, are produced, and you will modular property are similar, but there are key variations that impact the money you can use.

- Of several software have to have the where you can find have at least 400 square feet away from living space.

- According to your situation, an unsecured loan tends to be a much better selection than a house financing.

Mobile homes was a far greater fit for certain homeowners than just conventional households. You’ve got a lesser funds, wanted an inferior place, or need certainly to move the house afterwards.

Particular mobile home loans

You have got a number of options for mobile mortgage brokers depending on their advance payment, credit history, and you can measurements of our home. A knowledgeable match may also go lower to if or not need a cellular, are made, otherwise modular home.

FHA money

You can buy an FHA financing to own possibly a manufactured otherwise modular household. You are getting which by way of a timeless financial, however it is backed by new Federal Housing Government, an element of the You Agency regarding Housing and you may Metropolitan Creativity.

There are two main version of FHA loans having manufactured and you may modular homes: Term We and Title II. Title I financing are acclimatized to purchase a property although not the residential property it lies on the. The total amount you could acquire hinges on which type of possessions youre to get, nevertheless have relatively reasonable credit limits. A concept I financing could well be recommended while coping with a smaller finances.

Label II fund are used to pick both the house and the homes the lower. The house need to fulfill certain standards, eg which have 400 sq ft from living area.

Va money

Financing backed by the latest Company out-of Veterans Products (generally called Virtual assistant funds) is actually having qualifying active army members, pros, in addition to their family. You can utilize a beneficial Va loan to buy a manufactured otherwise modular house.

You don’t have a down payment when you get a beneficial Va mortgage, plus the lowest credit rating requisite relies on and that lender you use.

USDA finance

You can make use of that loan supported by the usa Service out-of Agriculture to acquire a created or modular house. So you’re able to qualify for a beneficial USDA financing, your house needs at least eight hundred square feet out of living space, therefore must have started built on or shortly after .

Just as in a good Va financing, there is no need an advance payment, and credit history need is dependent on the financial institution.

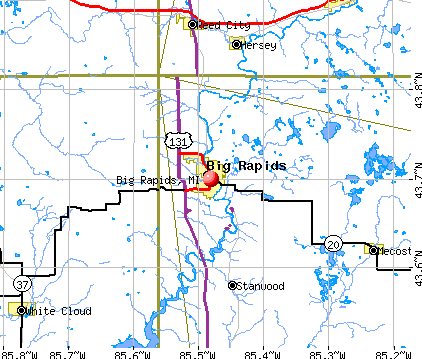

Note: USDA financing try having homes into the outlying section, and you also must have a minimal-to-moderate earnings to help you be considered. Maximum money top relies on your geographical area. You will find their county’s money maximum here.

Antique finance

The Fannie mae MH Advantage Program is for were created land. You’ll get a 30-season repaired-price mortgage, and therefore system even offers lower rates of interest on are manufactured mortgage brokers than you possibly might discovered somewhere else.

Need a great 3% down-payment as well as the very least an effective 620 credit rating. The home plus have to meet particular criteria – such as for instance, it ought to be a minimum of a dozen feet wide and possess 600 sqft regarding living area.

Freddie Mac also offers fund to possess are created residential property, and select from a number of repaired-price and you will adjustable-speed conditions. Such as Federal national mortgage association, Freddie Mac computer requires the where you can find fulfill criteria. The house payday loan Texas online must be at the very least 12 foot wide with 400 sq ft out of living area.