A property collateral mortgage, otherwise next financial, will come because the a lump sum of money

October 7, 2024

Household Guarantee Financing

It is an alternative if you like the bucks to have a one-go out expenses, like a married relationship otherwise a kitchen area repair. This type of finance always promote repaired pricing, https://paydayloansconnecticut.com/murray/ you know precisely what your monthly premiums would-be whenever you’re taking you to definitely aside. Discover Next Mortgage loans right here.

We provide a fixed speed solution to the the next mortgages having an optimum name away from ten (15) ages. Several benefits at work around on your mortgage:

- Reduced closure costs

- Zero pre-commission penalty

- Chose maintenance (excludes 29 seasons fixed)

- Style of percentage choice

- Cash-aside refinances toward particular mortgage arrangements

A beneficial HELOC Try…

An excellent HELOC was a line of credit one to spins like a charge card and will be taken for large expenses, unforeseen expenditures, house renovations, debt consolidating(1) and/or instance. Such as credit cards, any time you pay certain or all money utilized about HELOC, the personal line of credit is respectively rejuvenated.

An excellent HELOC is actually a protected mortgage in that you are borrowing resistant to the security that was made in your residence. Generally, loan providers will let you acquire regarding 80 to help you 95 percent out-of your residence’s security.

After you receive good HELOC, you are offered a draw several months, or period of time where the personal line of credit usually stay open. Draw minutes generally speaking average ten years. Adopting the mark several months is more than, you enter the fresh repayment months, and therefore for accredited people, you can expect a rate which have a maximum label of fifteen (15) years.

Good HELOC Functions by…

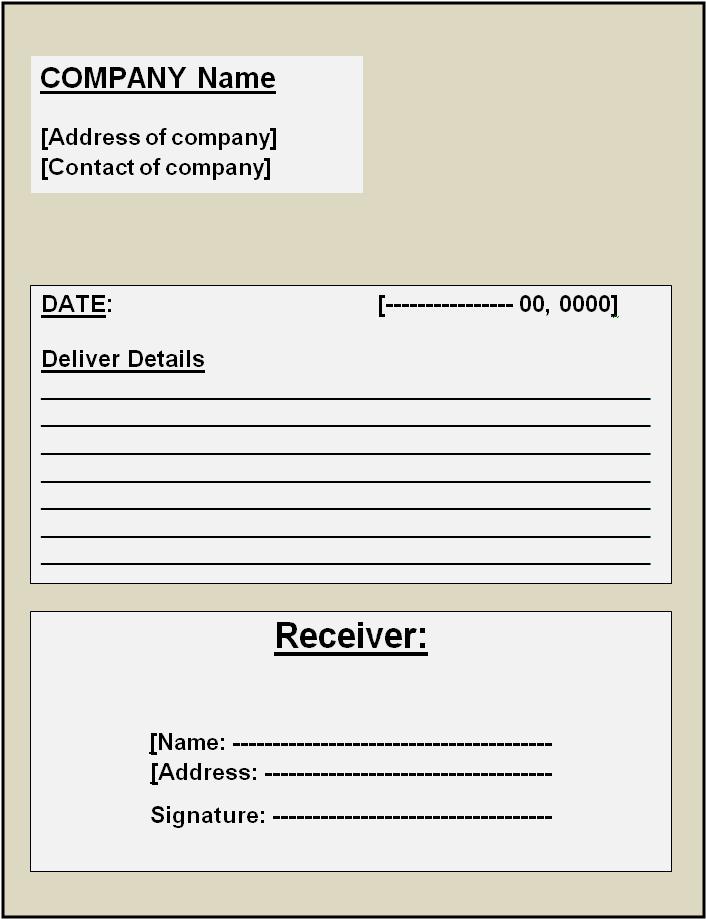

Consumers can use to own HELOCs as a result of AGCU’s Home loan Cardio. The lending company will assess the borrower’s domestic LTV (loan-to-value) proportion, and their money, credit history or any other personal debt. Such as home financing, HELOCs immediately after acknowledged are settlement costs. A home loan and you may HELOC document listing can be found right here.

HELOCs routinely have a variable rate hence, for the highest area, will be based into latest primary rates. This is why when costs rise as they was not too long ago the speed with the a great HELOC usually go up properly. Having said that, the speed on a good HELOC might be less than credit card pricing.

Once the HELOC might have been recognized, the debtor initiate brand new mark months. During this period, any cash borrowed about personal line of credit was paid back for every few days by-interest-only costs, which could suggest a diminished payment per month. If the draw months is more than, the fresh debtor moves into the installment months, when big date the latest payment begins to is dominant together with focus for any money lent, definition the latest payment may improve.

The Levels out-of HELOCs

Most household equity personal lines of credit enjoys several phases. First, a blow period, often a decade, where you have access to your offered credit since you favor. Usually, HELOC deals only need small, interest-just costs within the draw period, however could have the option to blow more while having it go towards the the principal.

Following the draw period ends, you might sometimes request an extension. Or even, the loan goes into brand new cost stage. From here to the away, you could not availableness even more financing, and you build regular dominant-plus-attract money before the balance disappears. Extremely loan providers keeps good 20-year cost period shortly after a good 10-seasons draw period. Inside fees months, you ought to repay all the currency you’ve borrowed, and notice within a developed speed. Specific loan providers can offer individuals different types of installment alternatives for the cost several months.

AGCU Mortgage Cardio

Most of the borrower varies, and now we give a variety of situations to meet your requirements. We improve mortgage techniques basic straightforward by providing the fresh most recent during the monetary tools where you can make voice financial choices. Whatever your a property credit demands is actually, AGCU has arrived so you’re able to browse the procedure. Telephone call all of us out of mortgage gurus at the 866-508-2428(AGCU) or current email address all of us for more information.