Such as, you might make bring contingent abreast of taking financing approval or selling your current domestic

October 4, 2024

Generate an offer to your a house

When you find a property we would like to pick, you need to submit a deal towards seller. This file has the degree of your own promote, the newest earnest currency you want to offer (generally 1% to three% of one’s promote number), your down-payment amount, brand new expiration day of bring, plus suggested closing day. Have contingencies.

Fill out Financial App

Now you must to try to get an ally financial. You need to submit private data files, usually including lender comments, employment info, evidence of income, and you can taxation statements, certainly almost every other ideas. Within 3 days out of giving your application, Friend ought to provide an online financing guess, that has your own estimated settlement costs, insurance coverage and you can income tax costs, rate of interest, and you can monthly payment.

Before you apply to possess a friend mortgage, make sure to enjoys digital duplicates of all of the files you may require. If you fail to complete the software in a single seated, the fresh Ally system usually keep your details, allowing you to start the place you left off from the a later date.

Hold off While in the Underwriting

Next, your house application for the loan thoughts to underwriting, and this will take two to three weeks. In this techniques, a friend mortgage professional you’ll request additional data, eg a copy away from a bad credit installment loans Portland PA separation decree otherwise proof beginner financing repayments. The fresh new underwriter will ensure the accuracy of the paperwork to decide their qualification to your mortgage. Into the underwriting processes, Friend you are going to create an assessment fulfilling getting a property analysis. Regarding the underwriting procedure, your Ally mortgage expert must provide your having reputation about the latest loan’s progress.

Get your Financial Approved or Denied

To locate recognition, you will need to fulfill Ally’s financing recommendations. Approval relies on your credit score, debt-to-money ratio, deposit amount, and a position record.

Intimate

Ally tend to inform you of one’s closing venue, big date, and some time and offer a great revelation that talks of this new closing costs and latest loan terminology. Conventional closings need you to signal the related files at an excellent specified area. Friend now offers a hybrid closing alternative, that enables one to digitally signal new data on the internet and provides them notarized privately having a notary. Either, you might apply the brand new earnest money your repaid after you recorded a deal on the the closing costs.

During the closure, you ought to shell out settlement costs, and that generally amount to dos% in order to 5% of your home’s purchase price. As an example, if you purchase a home to possess $three hundred,000, you ought to spend $six,000 to help you $15,000 in conclusion costs.

Friend Bank Rates and you will Charge

Some mortgage brokers fees consumers a loan application fee and you can costs having origination and underwriting. Ally Financial charge no bank fees to own lenders.

On the web Sense

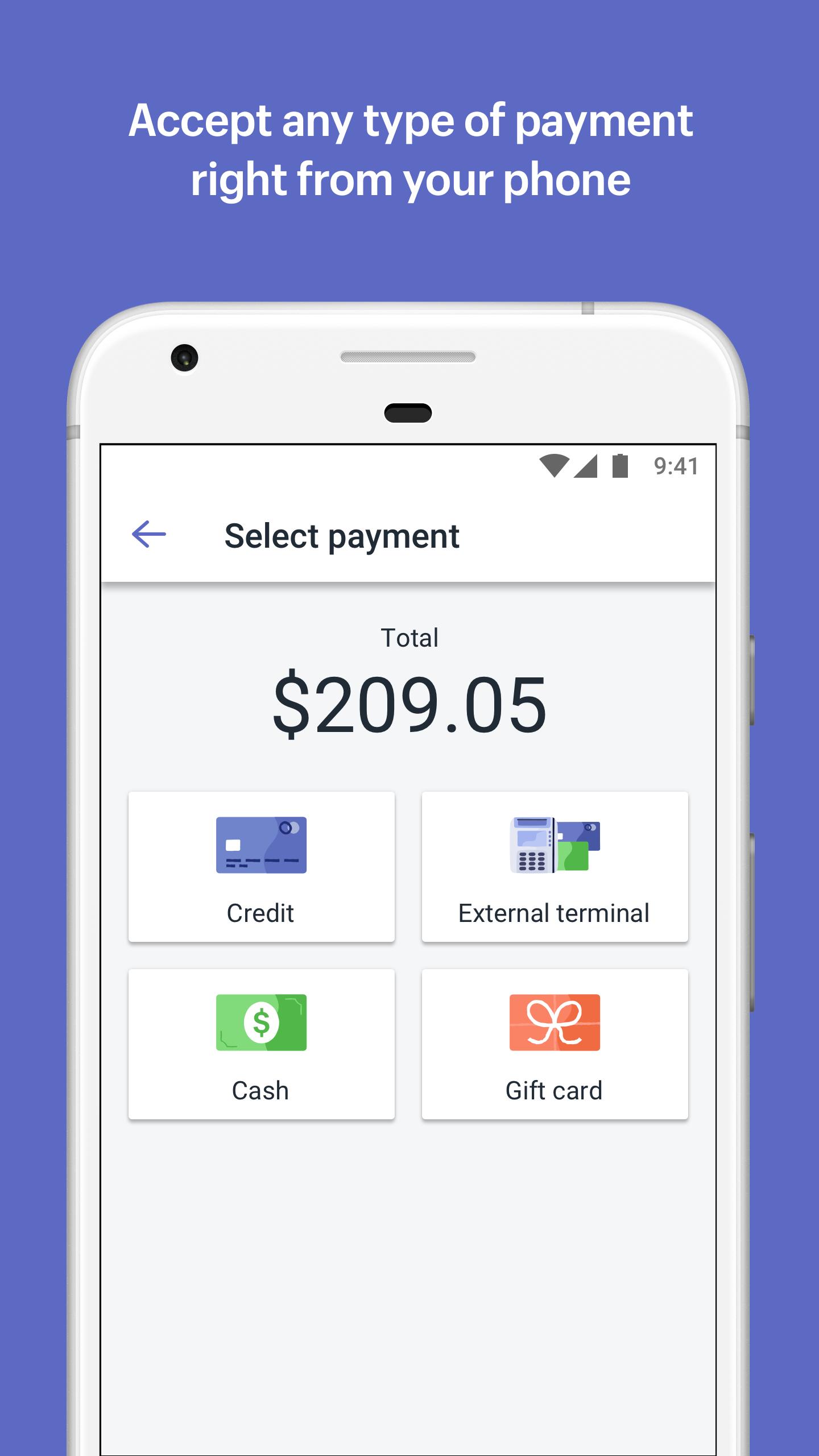

Ally’s the-digital banking means allows you to apply to your rate and you can song their loan’s improvements throughout the capability of your computer or laptop otherwise mobile device. The lender’s home loan squeeze page status interest rates everyday, that may help you select local plumber to try to get that loan or demand an increase secure. Since the you’ll spend no bank fees with Friend, in addition there are pre-approved and you can fill in an application free-of-charge.

Whether you’re researching owning a home, definitely looking property, otherwise enjoys finalized a buy agreement, Ally’s pre-recognition software allows you to request pre-approval according to the timeline. Immediately after you are pre-accepted, you might go back to the fresh Friend website to get financing as you prepare purchasing property.

First-day homebuyers will enjoy Ally’s calculators to assist them to regulate how far they can be able to obtain and exactly how mortgage money usually affect the monthly budget. The fresh new lender’s academic information bring a great deal of understanding of cost management to buy a home, state home-buying apps, rates of interest, refinancing, off payments, and.