Domestic equity financing are an easy way to cover higher costs. Heres steps to make many of your loan

October 1, 2024

Tapping into their home’s equity will likely be useful in different ways. You can access the money must coverage extreme expenses, alter your finances or even for anything else the truth is fit.

However, you will need to go-ahead which have warning whenever borrowing from the bank from the roof more your head-incapacity and then make fast costs can result in foreclosure

What exactly is family guarantee?

Domestic collateral ‘s the part of your residence which you have paid off out-of. This is the difference between just what house is really worth and how much continues to be owed on your own financial. For many, security out-of homeownership try an option treatment for generate individual riches over time. Since your home’s value expands across the lasting and you also lower the main with the mortgage, your own equity develops.

Equity will bring of several possibilities to home owners, because it’s good source for savings as well as financial support, states Glenn Brunker, chairman at Friend Household. Such, new equity accumulated into the a beginner family get later provide the deposit wanted to get more substantial house once the a household develops and requires extra space. It’s a period-checked out way to create wide range.

House guarantee is typically useful huge costs and frequently means a far more cost-productive resource choice than simply credit cards otherwise personal loans with a high interest levels.

Just how house guarantee really works

Widely known a way to accessibility the brand new security of your home was good HELOC, a home collateral financing and an earnings-aside refinance.

So you’re able to make use of your own home’s guarantee as a result of one of these alternatives, you’ll want to go through a process similar to getting an excellent financial short term loans Calhan. You could potentially use by way of a lender, borrowing from the bank commitment, on the web financial or other financial institution that provides these types of home guarantee circumstances.

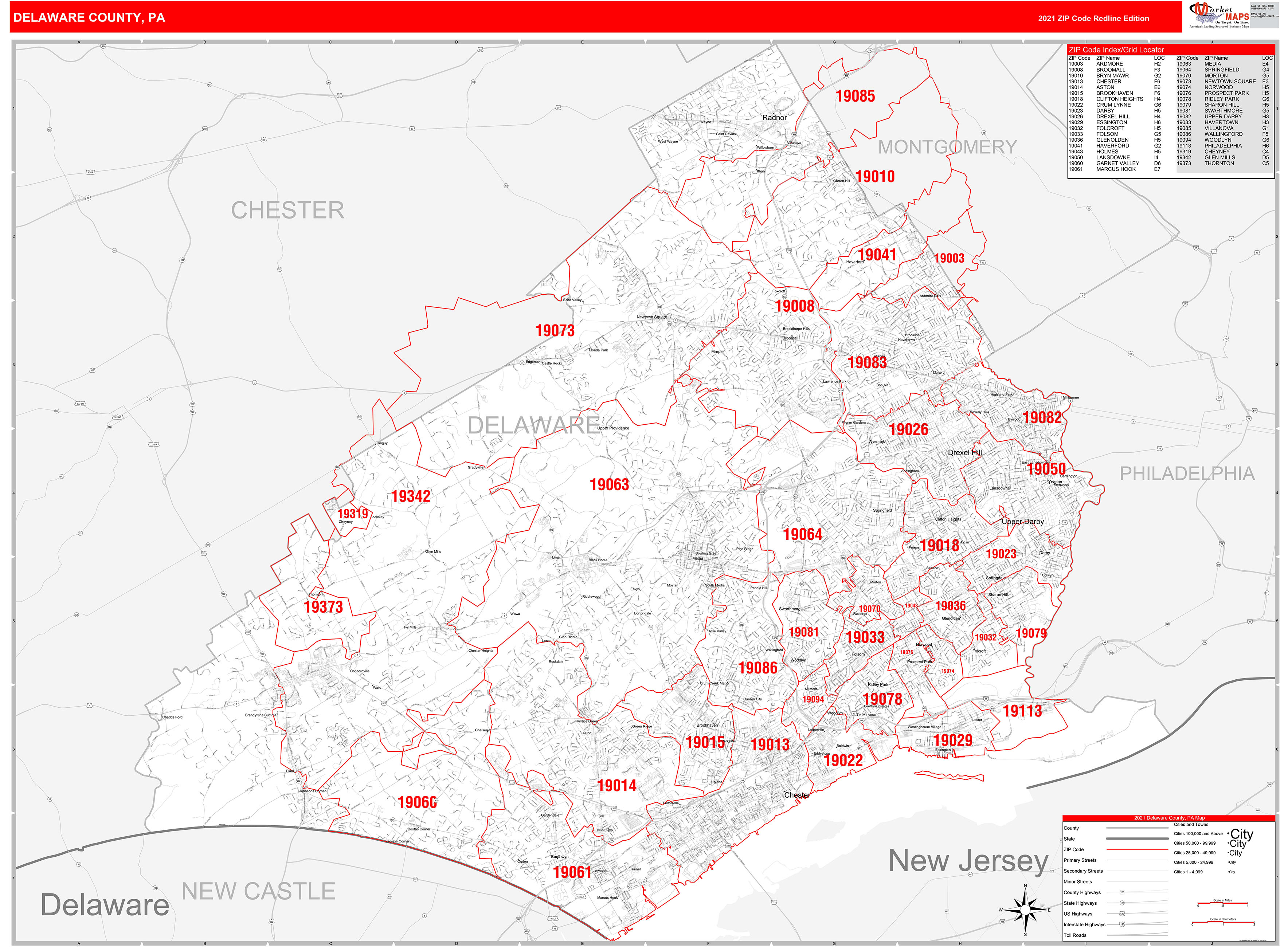

Lenders will think multiple circumstances, and someone’s financial obligation-to-income proportion, loan-to-worthy of proportion, credit rating, and yearly income, said Michele Hammond, elder family financing mentor on Chase Private Consumer House Credit. On the other hand, to select the amount of guarantee in property, a loan provider commonly employ an appraiser to select the market property value the home, which is predicated on the criteria and you can equivalent qualities on the city.

Why have fun with household collateral?

Tapping your house guarantee might be a convenient, low-prices treatment for acquire large sums at the positive interest rates in order to buy family repairs or debt consolidating.

If you’re looking to pay because you go and only spend for just what you’ve lent, when you have lent they, a HELOC is likely a far greater choice, states Sean Murphy, secretary vp of security lending in the Navy Government Borrowing Commitment. But if you are looking for a predetermined monthly payment and you will a big amount of cash beforehand, a house guarantee loan is amongst the better option.

seven how can i have fun with a home guarantee financing

You’ll find few restrictions on how you should use your residence equity, however, there are lots of effective ways to maximize of one’s loan or credit line.

1. Renovations

Do-it-yourself the most well-known factors home owners need aside domestic guarantee finance otherwise HELOCs. Along with and also make a home easier for your, enhancements could raise the home’s well worth and you will mark much more focus out of prospective customers once you sell it after.

Household collateral is a superb solution to money high tactics such as for instance a kitchen area recovery that may improve good residence’s worthy of throughout the years, Brunker claims. Many times, these types of assets will pay for on their own of the increasing the home’s really worth.

One other reason to adopt a home guarantee mortgage or HELOC to own renovations is that you could deduct the attention paid off towards domestic equity finance of up to $750,100 if you are using the mortgage money to purchase, generate or considerably boost the family that obtains the loan.